France

Paris

Switch to your local agency

Retour au menu

In May 2019, our IMG report Direct to Consumer revolutionappeared, dedicated to DTC brands, native digital players who, by disintermediating the value chain, are redefining the frontiers of certain specific industries.

From then on, many things have changed, and the DTC phenomenon, accelerated by the digitalisation attained during the pandemic, has affected the rules of the game in various sectors, even in Italy.

Just consider what has happened here with us over the last six months:

The reason why even established brands are making their moves – no longer timidly – in DTC can be explained in terms of three fundamental objectives

However, these three forms of leverage, absolutely crucial for consolidated structures, are no longer something innovative for consumers, who in the meantime have developed new expectations: the bar has been raised, to the point that the public does not just desire, but positively expects, an impeccable customer care, excellent design, faultless wow experiences, a website and social media packed with entertaining content, backed up by an exciting community.

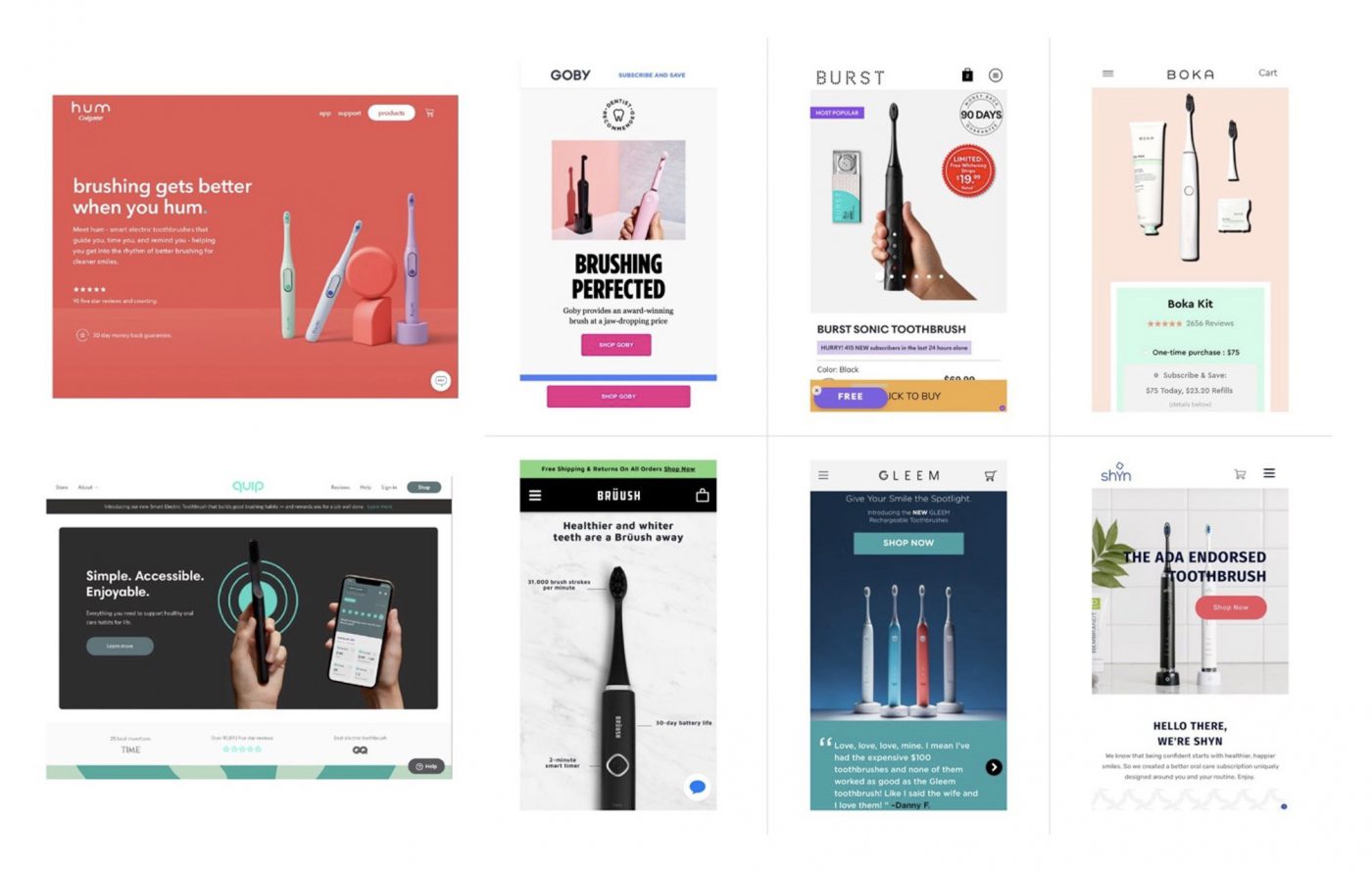

Many, above all at an international level, have interpreted this moment in history as a wave to be surfed, a golden opportunity for standing out on the market. But the result is exactly the opposite. In other words, there is a standardisation in terms of what is offered, created by the desire to follow “DTC laws” to the letter: considering a product category, such as electric toothbrushes, we see that the market is becoming saturated with identical products, with the same business model, the same design, the same communication strategy and tone of voice. We are witnessing a progressive uniformity of supply, and consumers find it difficult to find their way around, because all brands are responding to the same need in exactly the same way.

We are also seeing an increase in CPA(cost per acquisition), precisely because the powerful model based on social media communications, adopted early on by DTC brands, has become the principal sales channel for most DTCs, pushing costs sky-high.

There is yet more: DTC brands, in their DNA, have a specific response to the needs of a niche target. This “obsession” with a specific niche, something that for some time has denoted these brands’ power and success, is now beginning to crumble: by now, the niche has beenreached, if not by the brand itself, by one of its competitors, and growth, in terms of volume, has become very hard to attain, unless by applying new strategies for expanding the portfolio and/or services.

What is the added value that big brands can bring to this by now saturated market?

The entry of big brands into this market could make waves and bring some interesting innovations at a moment of notable difficulty for the smaller players:

BUT… There is still a big BUT.

Both DTC brands and big brands will soon find themselves fighting a shared enemy…

Having eliminated the old intermediaries is no longer enough. New middlemen are appearing and they will steal the privileged position of direct contact with consumers. Just think of the inexorable growth of voice shopping.

In an ever-nearer future, voice assistants will choose for us, according to our purchasing habits, but also strongly promoting proprietary brands, or those willing to pay in order to be selected automatically. This will lead to the arrival of incidental loyalty, in other words, the birth of a fidelity linked to decisions over which the user has no control.

So, the fight for disintermediation continues…

Privacy Overview