What's the future of banking?

“It is clear that digital technology has redefined roles and confines in the financial industry, Nowadays, in order to manage the complexity and speed of transformation, what is needed is a profound cultural change, a neutral and open opportunity for contamination which provides banks and financial institutions with the possibility to identify new stimuli and instruments on which to construct innovative models of competition.” This is how Paolo Zaccardi, CEO of Fabrick, explains the new open banking project for Sella that we have been working on.

An ambitious, courageous and innovative challenge which saw us involved in the setting out of the value proposition for the new ecosystem, which was necessary for the definition of the strategic platform for the brand and the key values, leading to the naming and identifying of the brand.

The fruitful encounter

Openness, growth and accessibility are the guiding principles, the distinguishing key values which emerged from a detailed analysis not only of the identity and vision of Sella, but also of the requirements of all of the main players involved in the ecosystem and market.

“To manage the transformation with a view to openness, in a moment of great market complexity, in which it is necessary to have a guide, a direction, and answers, which are all in line with the values of Sella”: this was the clear position which emerged from conversations with the main internal stakeholders, allowing us to gain detailed understanding of the heart and vision of the company for which we designed the brand language.

“It is fundamental to interact with other actors via an ecosystem which promotes collaboration, not only functional integration: we need something more than a digital platform in order to grow”. Contamination which generates value is a crucial aspect not only for FinTech, but it is a decisive factor also for players in the banking world who will form part of the ecosystem: “Banks are often too slow to evolve alone. Participating in an ecosystem allows them to have access to common fertile ground, in which the plants that grow there respond to the needs of all our clients. The factor that makes the difference will be the ability to unite diverse subjects, to enable contamination in order to generate new value”.

Value, for who? Among others, corporate clients who will be able to have simplified access to financial products and services: “the bank of the future simplifies access for me and allows me to reduce time and money wasted in tasks of low added value”.

“Despite the fact that there are still no direct competitors on the market, the desk research was very useful for identifying similar language from which to distance or differentiate ourselves, such as for example the API marketplace, incubators and accelerators, in order not to run the risk of positioning ourselves incorrectly on the market” explains Irene Serafica, Head of Strategic Design at CBA.

“Fabrick”: a name that combines entrepreneurship with the future of the financial system.

“The name Fabrick is the result of a semantic exploration of the key values of the brand which led us to design a name which, above all, lends value to the ideas of encounter and contamination, and the creation of value.” This is how Cristiano Mauri, Client Director at CBA, explains the decision to combine the terms “fabric” and “brick”, those with which the new ecosystem is constructed. Fabric is not only a reference to the interweaving of players within the ecosystem, but it also evokes the business history of the Sella family. The bricks represent the players involved, a form of finance which has become accessible and modular, and which can be combined according to requirements. The two concepts come together in the name “Fabrick”, which is also a reference to factories, to making, to building value together.

An open and flexible brand identity

“The era of monolithic services, where a bank independently offers all the traditional products, is over. The new way of banking is based on an openness to collaboration with third parties, to FinTech, to Big Tech operators and, why not, even to traditional competitors and insurance companies, in order to be able to create services with added value for the end user, who must be allowed to regain a central role in the market”, says Paolo Zaccardi.

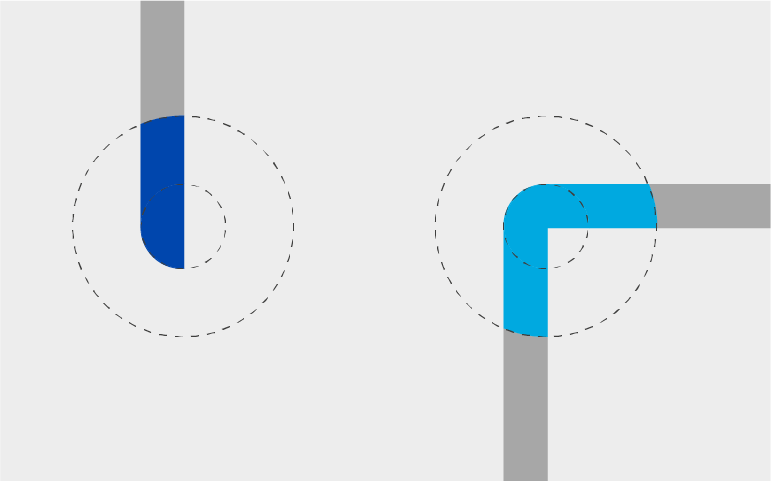

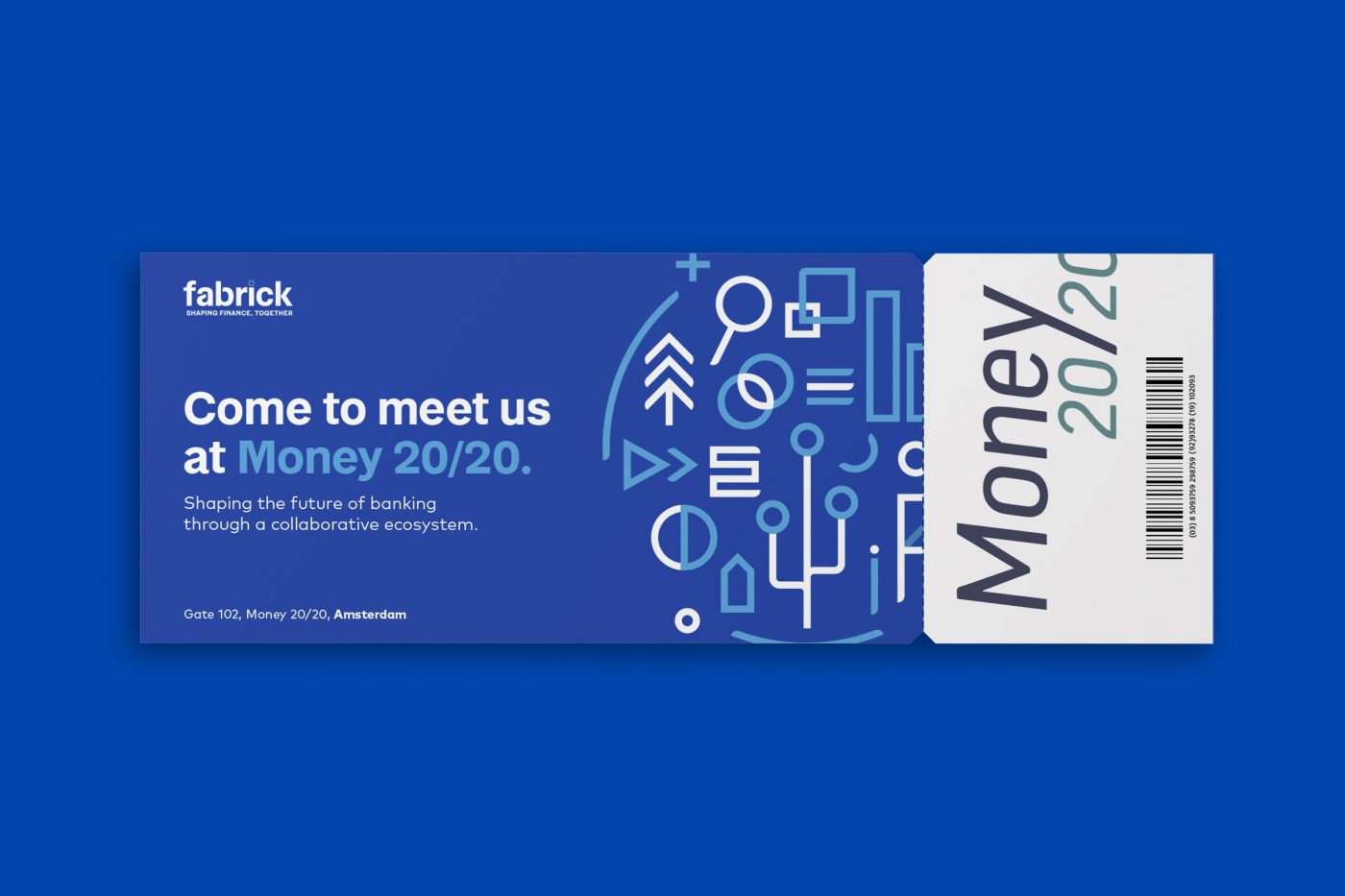

Massimiliano Frangi, our Associate Creative Director, describe the Fabrick visual identity: u0022Distancing ourselves from a static and traditional market identity, we have summarised the benefits of the ecosystem via a series of icons which, as though magnetically attracted to each other, come together to form a circular nucleus. A form which is defined but which is boundless, open and ready to accommodate other elements and to express its full potential. The strength of the Fabrick identity lies in the fact that it is an open, flexible and recognisable languageu0022.

It is not an identity which is created through a dominant brand identity which is imposed on everything, but it is, on the contrary, an open and flexible visual system which can be applied to various touchpoints and adapted to differing forms of content.

Fabrick will be a FinTech entity with a team of approximately 270 and, according to estimates, with more than 30 million in turnover, made up of a group of innovative companies with significant growth potential, such as: Hype, Axerve, Vipera, Kubique, Codd&Date, Innoblue, dpixel, Fintech District and Sella. A company with a new structure and mission, with entrepreneurial managers open to capital and to creating strategic partnerships with the most innovative banking and FinTech entities.