Lately, disruptors has become a regularly-recited fact. Understanding who it refers to is easy and realising that this really is the case has a certain impact.

On going into detail, it emerges that the reality is more complex than a phrase created to amaze, both in terms of the online origin of success (Netflix began by sending DVDs by post), the physical presence (Amazon has opened an experimental shop in Seattle), and procurement strategies (Uber has purchased an articulated lorry start-up more for the autonomous driving technology than for the lorries themselves).

The new giants which have developed online, overturning their markets by replicating a business model founded on the non-ownership of assets, seem now to be looking with interest at the purchase of some form of physical property.

But this is not the case for everyone. In what direction are these companies moving nowadays?

Amazon and Alibaba are investing in the purchase of physical store chains. A few months ago, Amazon purchased Whole Foods (specialised in organic food), while Alibaba has acquired a significant share in Sun Art Retail, the Chinese version of Wal-Mart. Rather than a show of aggression towards the offline market, these strategies seem to be a form of u0022prototypeu0022 aimed at the definitive integration of online and offline experiences.

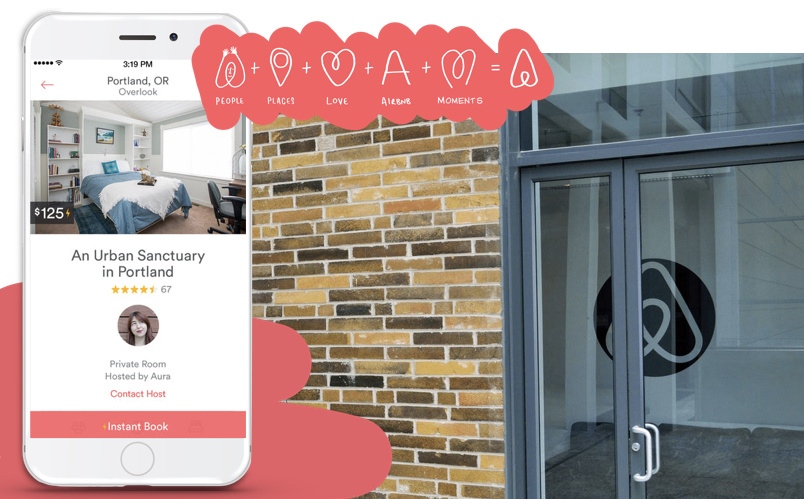

In the US, Airbnb has begun investing in a number of apartment complexes, built from scratch and managed according to new methods, obviously perfect for residents who will be hosts, but who are, above all, frequent travellers themselves.

Uber has tested vehicle purchasing in Singapore, with poor success. It is, however, investing in revolutionary flying taxis which it will presumably have to own.

(The question also remains on how to manage in the future an asset-free model with driverless vehicles. Will the owner provide the self-driving car, working for Uber yet staying at home?)

For Netflix, considering the way in which it works, the dynamics have been similar, but without ever abandoning the immaterial: explosive penetration of the market and investment of earnings to free itself from dependence on entertainment leaders – in this case through the production of original material.

With regards to physical assets, is a macro trend for these actions emerging?

Certainly, the strategies differ for the various markets, and are applied in differing contexts, but none of these companies seems to be focused on snatching up assets depreciated by competitors.

There is no Airbnb buying up Holiday Inn or Uber taking over taxi companies being sold off. On the contrary, they all seem to be concentrating on strategies which are focused on a distant future, as though the inability of old-style competitors to adapt, their consequential disappearance, and even the uselessness of the goods which they are now founded on seem to be so taken for granted as to almost not even merit attention.

There are two lessons to be learned from all of this:

Even in the offline world, where until yesterday the definition of relationships of strength and services was in the hands of the traditional large-scale players, the rules are, nowadays, ever-increasingly set by the asset-light disruptors.

These all seem to be driven by the same rule which many very large-scale companies, now no longer in existence, have instead ignored: think about reinventing yourself before it becomes necessary.

Alberto Gianera

Strategic Designer

References:

- Alibaba Bets $2.9 Billion It Can Take on Wal-Mart in China

- Amazon to Cut Prices at Whole Foods After Acquisition Closes

- What is Amazon Go?

- Airbnb-Branded Apartment Buildings Are Coming to the U.S.

- Uber paid $680 million for self-driving truck company Otto for the tech, not the trucks

- Buying its own cars went disastrously wrong for Uber in Singapore

- The unique strategy Netflix deployed to reach 90 million worldwide subscribers