The indirect brand economy which spanned more than a century (from 1879 to 2010) was based on a tried and tested process. Brands passed through various intermediaries, beginning with the advertising agency, via publishing houses and distributors, and coming, at the very end, to the consumers.

Dominating the distribution chain thus meant dominating the market.

Now, the growth resulting from digital distribution is undergoing a shift towards the direct-to-consumer formula: the existence of the cloud allows never-before-seen ways to enter into contact with the market, pushing brands to ever increasingly connect directly with consumers.

What are the ingredients for this new winning formula? By taking advantage of the transformation in the supply chain panorama which is centred on information technology and the net, native digital players (mattresses, kitchenware, luggage and even sheets, to name but a few) are capable of proposing a higher-quality product and service experience at a quarter of the typical price. But how?

They listen to their consumers

The New York brand Care Of presents its clients with a thorough 48-question survey before putting together a proposal for supplements which is suited to their specific requirements and/or deficiencies.

An obsessive focus on customer experience

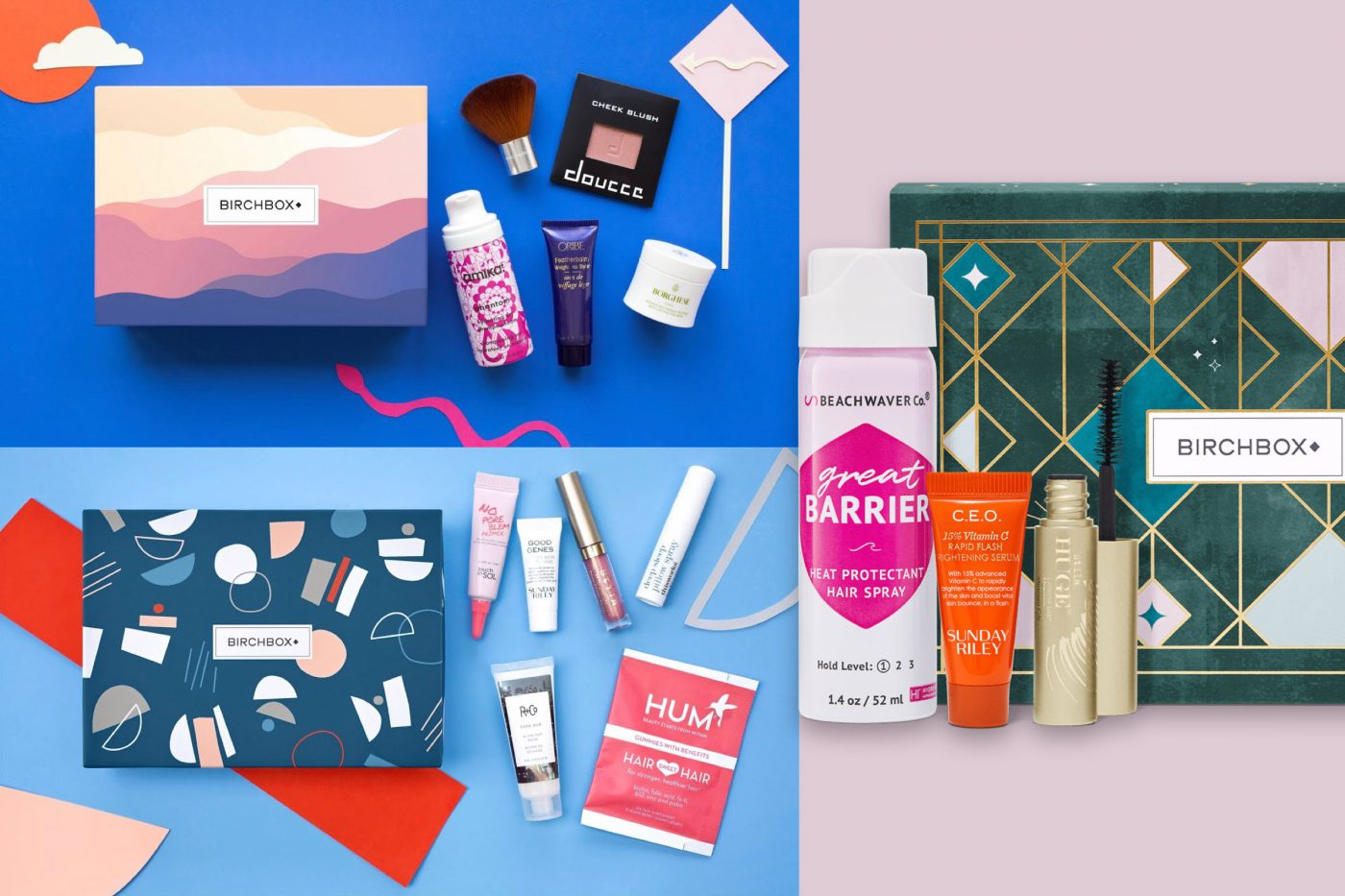

Every month, Birchbox, a subscription make-up service, offers its clients as many as 5 samples of new cosmetic products to try. This provides for a successful surprise effect, accompanied by a particularly captivating unboxing experience (every month there is a package with a particular design).

They use content as a differentiating element

Storytelling is a central element in their communication. Huel offers its consumers a new and articulated point of view of nutrition via a range of recipes studied by professional nutritionists. They do not limit themselves to promoting the quality of their product. Instead, they fight to raise awareness on the food emergency and the excessive exploitation of environmental resources for the production of food of animal origin.

Their mission is their story

One outstanding example is the Ohne brand of organic cotton sanitary pads which focuses its communication on overcoming the taboo of menstruation, still often seen as a source of embarrassment. The brand has embraced the mission of combating all of the gender stereotypes, going beyond the specific theme of menstruation.

They begin with data

They independently collect data on their clients in order to guarantee a tailor-made approach. Graze analyses the tastes of its consumers before sending them the monthly box of snacks, thus selecting only the items which are most in line with their preferences.

They have a new strategy for opening retail points

Boll & Branch, which proposes organic cotton sheets, has decided to open a bricks-and-mortar retail store in response to the desire of its clientele to have hands-on experience of the pleasure and quality of the products, demonstrating the modern and unusual passage from online to offline (rather than the opposite, which was the case in the past).

Where does the innovation lie? How do they manage to stand out so much from the crowd?

By side-stepping traditional channels, designing the product in-house and creating a relationship of extreme trust with clients which is based on shared values.

These brands have been consolidating growth and turnover for a number of years now, becoming reference points rather than a flash in the pan. In illustration, Gillette’s market share for men’s razors in the USA fell in 2016 to 54% from the 2010 level of 70%, while the shares of the Dollar Shave Club and Harry’s have climbed to 12.2% from 7.2% in 2015 (Fox Business, 2017); the increase in turnover of grocery stores in general is forecast to be around 1% in 2022, while the meal kit market is expected to grow ten-fold in the same period2.

The fundamental idea of these small emerging entities is that their business model is based on a relationship with the client. It is a relationship which takes the form of personalised services and with a customer experience which has never been tried before, where what really counts is the overall service, embodying positive desires, values and emotions more than the physical product itself. Through continuous feedback and two-way communication, brands can constantly improve this relational aspect.

All of this has an effect not only on entities which are currently emerging, but also on those which are already established, leading to a re-thinking of the roles of all the channels of communication and contact with brands, including bricks-and-mortar stores which far from disappearing are ever increasingly conceived to complete (or begin) that which digital spaces have started. It is no coincidence that even a brand such as Nike is following the example of new, small-scale entities, adapting to direct-to-consumer trends, and between 2010 and 2020, the forecasts for the results of its new direct-to-consumer strategies show a shift in turnover from 19 billion dollars to 50 billion.

Irene Serafica

Chief Strategy Officer at CBA