France

Paris

Switch to your local agency

Retour au menu

In a world characterised by a frenetic pace, where changes are continuous and technological innovations are increasingly surprising, organisations face enormous challenges. The emergence of new generations of consumers, with different needs and behaviours, confronts companies with unprecedented scenarios, generating stress and the need for constant adaptation.

Faced with these challenges, organisations question themselves deeply about their future. There is a growing need to imagine a sustainable and profitable development that can guide companies through the uncertainties of an ever-changing market. Indeed, as the range of products and services expands, the more complex and complicated the brand becomes to manage.

In this context, a technical and strategic discipline such as Brand Architecture assumes a key role. The definition or evolution of a brand architecture is not only a marketing issue, but becomes a key element for the long-term corporate strategy. In our role as branding experts, we work daily with both emerging startups and large holding companies. Our goal is to build a clear and visionary future together, one that can interpret and anticipate market trends.

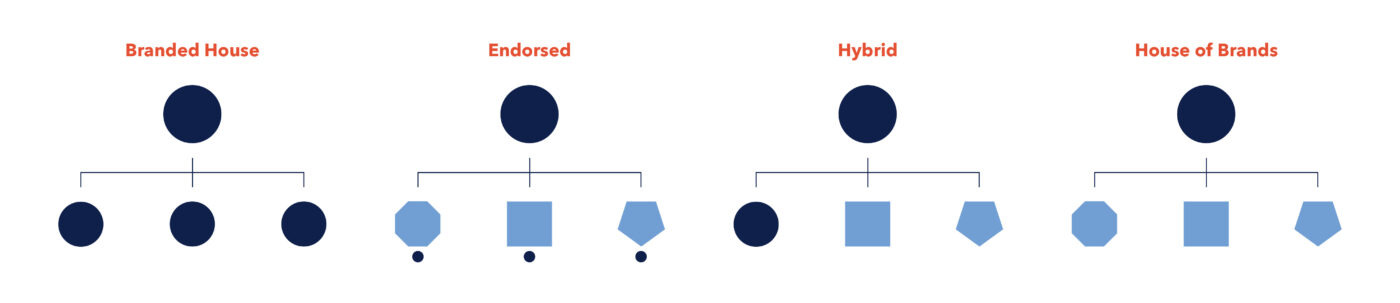

Before telling you about some of our case studies, it is useful to outline the main Brand Architecture models, in a quick but thorough way.

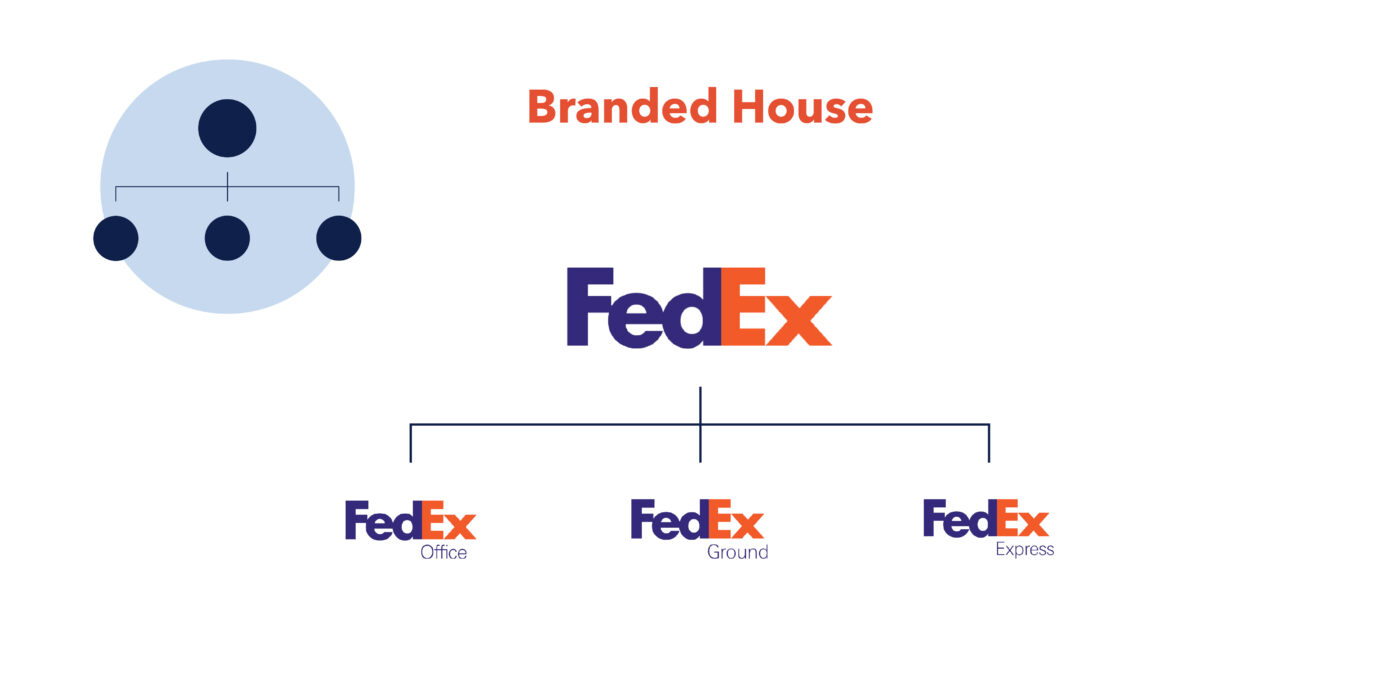

Branded House. Unity is strength

In the ‘Branded House’ model, the organisation uses a single brand, which is branched with different descriptors to identify all its products or services. This approach offers consistency and ease of brand management, reinforces core brand recognition and allows economies of scale in terms of marketing and communication.

Communication

PRO: the possibility to exploit the image and notoriety of the main brand; lower communication costs because they are shared

CON: the risk of reputational damage to a sub-brand could extend to the main brand

Commercial

PRO: it forms economies of scale, thanks to the economic efforts focused on a single brand

CON: acquisition of new brands forces rebranding and the loss of equity

Internal Culture

PRO: a strong sense of brand-belonging by employees; the existence of a strong brand facilitates talent attraction

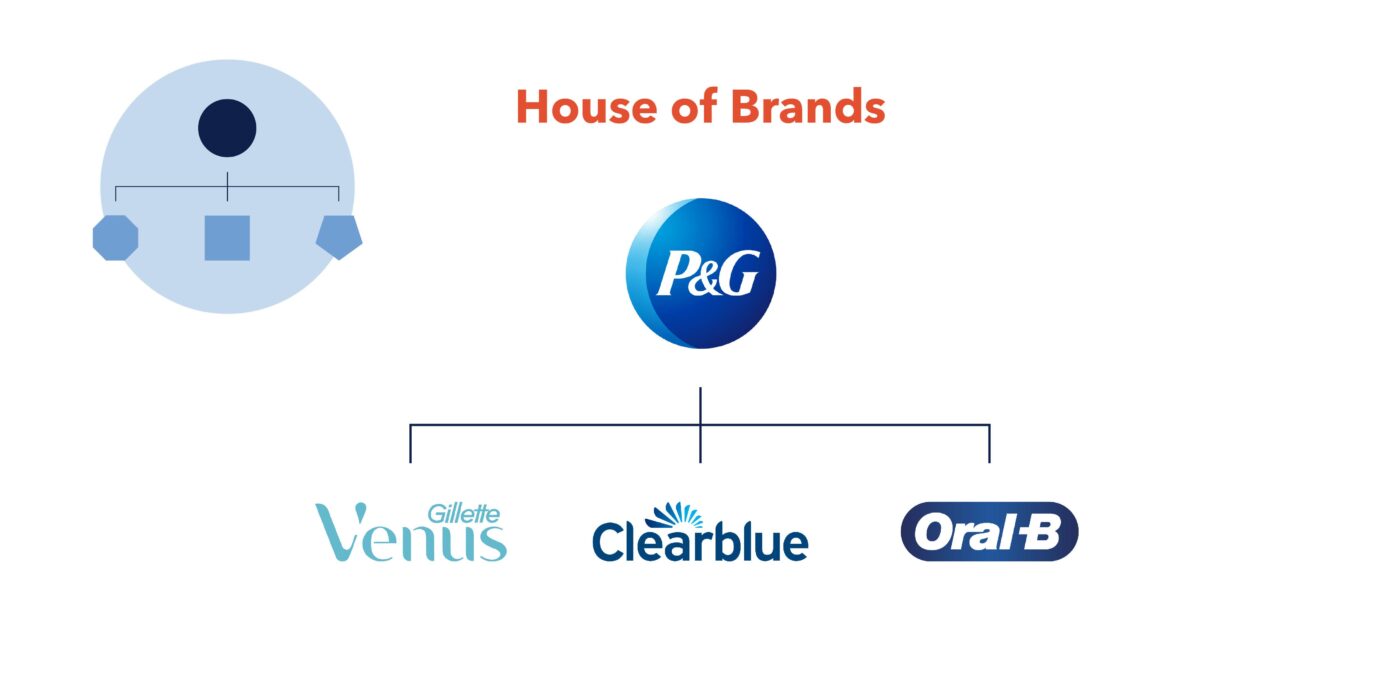

House of Brands. The strength of multiplicity

In contrast, in the ‘House of Brands’ model, the organisation operates a range of completely independent brands. This allows greater flexibility in the positioning of each individual brand, better market segmentation and the possibility to address different audiences without blurring the identity of each brand.

Communication

PRO: freedom and autonomy in adopting customised communication strategies

CON: risk of losing coherence in the group’s narrative, whose messages vary for each sub-brand

Commercial

PRO: greater diversification of business and investment opportunities

CON: lack of recognition of the main group/ brand; greater organisational and economic efforts

Internal Culture

PRO: each sub-brand can develop a distinctive internal culture

CON: the sense of belonging to the group requires more effort; the sharing of values and best practices must find a lowest common denominator

Since each brand is characterised by unique structures and thus distinct reactions to change, the two models listed above do not always provide adequate solutions. There is therefore an area where brand architecture offers different models, such as the ‘Hybrid‘ model or the ‘Endorsed‘ model.

And this is where, in our experience, most of the doubts and reflections are concentrated.

But when does the strategic definition of a brand architecture become fundamental?

Some of our case studies.

Following the acquisition of Altido, ChezNestor and Open, DoveVivo decided to unify the different operators under the same brand: Joivy. This union, guided by our strategic consultancy, required a gradual transition: a first step saw the retention of the acquired brands through the juxtaposition of an endorsement “by Joivy” (‘Endorsed Brands‘), to then arrive at the complete fusion and the definitive abandonment of the previous realities, in favour of a single international brand of living solutions.

We subsequently had to undertake a second deep dive with the client, to create the in-house real estate brokerage division of Joivy.

The launch of the new brand and its Investments division were planned at the same time, so it was essential to maintain a strong visual link between the two realities. This led us to apply a ‘Branded House‘ model for Joivy, maintaining a strong visual consistency, to allow the corporate to create awareness effectively and solidify its equity.

Openness, innovation, enterprise, growth: these are the value roots of the Sella Group, which have been translated and renewed in recent years through the birth of two new businesses: Lynfa, the Corporate Academy and Fabrick, the open banking platform.

We asked ourselves together with them which would be the right guidelines to direct the path of creation of these two new brands: to tend towards a ‘Branded House‘, thus maintaining the visual and verbal assets of the Group, or to break away towards a ‘House of Brands‘ model in order to enhance their DNA of values and their innovative “rupture” component?

In both cases, the most courageous choice, that of moving away from the mother brand, was also the most strategic, because it is the one that allowed the two brands to be attractive and open to new talent (Lynfa) and collaborations between different financial players (Fabrick).

For many years we have been partners with Gi Group, an Italian multinational operating in the labour market sector. We have seen this reality grow and expand, opening up to new markets, acquiring new players and incubating new realities. With this evolution, the Gi Group consumer brand was no longer able to hold all these players together.

It was necessary to think of a brand architecture with a higher level, capable of acting as guarantor of all the players, creating order and eliminating this overlap in the common imagination between consumer brand and parent company. We thus accompanied the client in defining the positioning and strategic platform of Gi Group Holding.

This is how the endorsement “Gi Group Holding” is realised within the different company’s logos.

Foundations do make a difference

In conclusion, it is crucial to emphasise the importance of a Brand Architecture that is in perfect harmony with the company’s evolution and ambitions.

This strategic decision, crucial for success, is based on careful listening and a deep understanding of the user’s needs, key elements in our work as a branding agency. A well-designed Brand Architecture not only defines external identity, but it is also an internal tool for alignment and cohesion.

This approach aligns internal forces towards a common goal and clarifies the company’s vision to all stakeholders, laying the foundation for sustainable growth and the success of each product or service. In a constantly changing world, a solid and market-conscious Brand Architecture is a beacon that guides companies towards a prosperous future.

Chiara Visconti, Designer at CBA

Alice Gravina, Designer Intern at CBA

CBA has recently found itself working with some Italian Foundations, connected to entrepreneurial entities that have been collaborating with us for years. It has been an opportunity to reflect on the role of branding within a sector like that of non-profit organizations. Today, in fact, there are many companies that decide to make a social or cultural contribution to the territory in which they do business through the instrument of the Foundation.

Foundations vary greatly from one another: they can be created in memory of people important to companies and their founders, to support philanthropic interests, or to continue pursuing the corporate purpose-related goals through other means when they cannot be met in a purely for-profit, entrepreneurial context.

There are several examples of Foundations that excel in expressing their value to the community, both by creating real impact and, not insignificantly, by leveraging branding as a strategic element at the core of effective communication. Let’s mention the Feltrinelli Foundation, which in Milan carries out its cultural and political work through a schedule of events and publications that always stem from the concept of a historical-archive library that delves into and questions the present from a strongly progressive and democratic perspective.

In a completely different style, but effective in its uniqueness, we can see the Prada Foundation, which since its inception has provocatively, avant-gardely, and freely questioned the function (and utility) of culture and art. For these organizations, branding is foundational to not only how they represent themselves but also how they consistently think and speak.

In our work with Foundations, we know that, just as when we work with corporate brands, we must study (strategy) and create (design) brand identities capable of conveying a Unique Value Proposition. In the case of Foundations, we must start from the values and mission that the founders deeply resonate with.

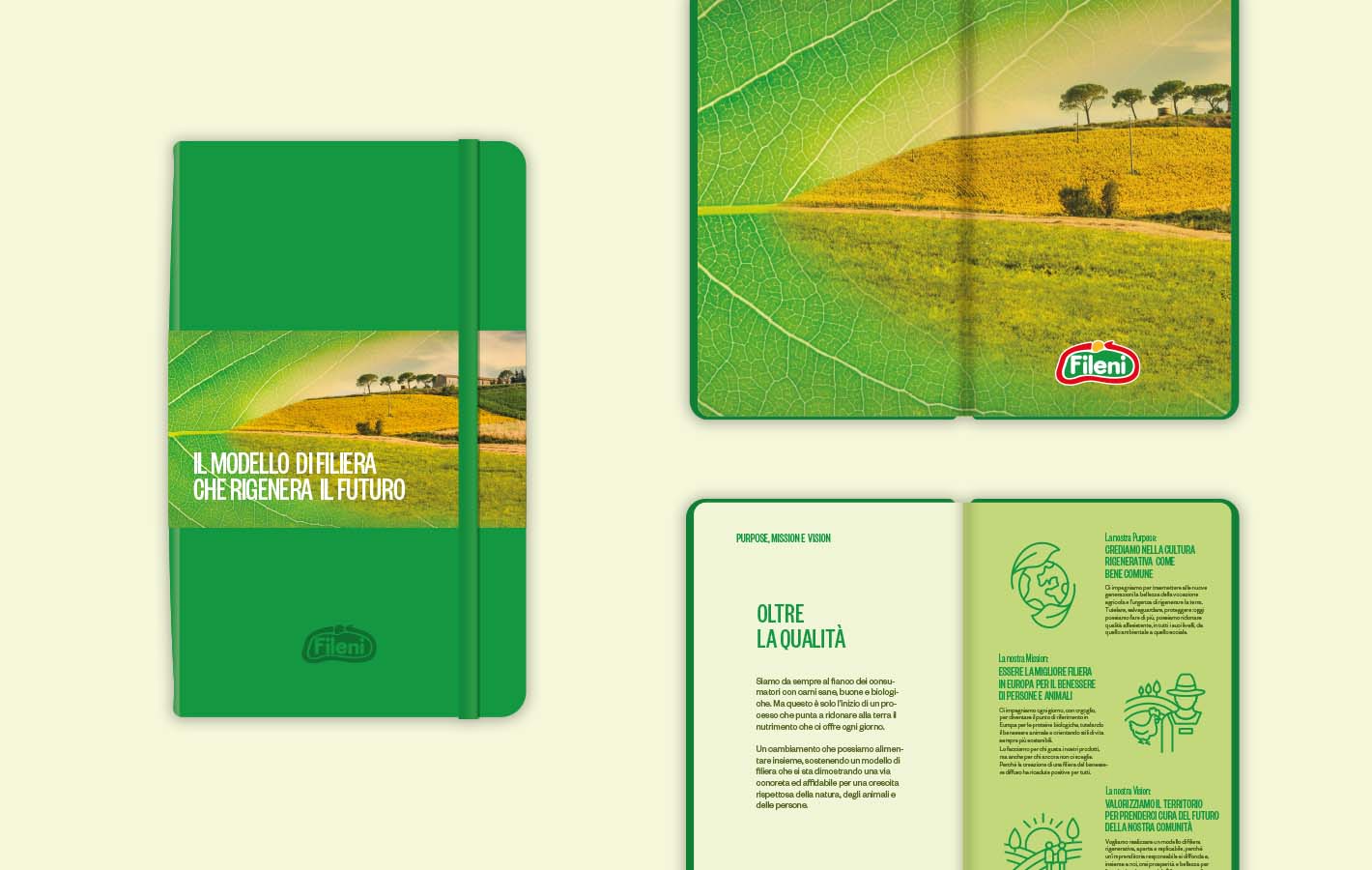

CBA has overseen the branding work for the Gi Group Foundation and the rebranding of the Marco Fileni Foundation. Through these projects, we’ve come to understand that there is no one-size-fits-all recipe for Foundation branding. In particular, we had to contemplate which paths to take, especially in terms of brand architecture, to clarify the relationship between the corporate brand and the Foundation brand.

In both cases we deepened our knowledge of the profound motivations (or reason why) related to the inception of these entities, and then designed visual identities that reflected their values, taking into account the diverse target audience they always address (beneficiaries of the activities on one hand, and territorial and institutional stakeholders on the other).

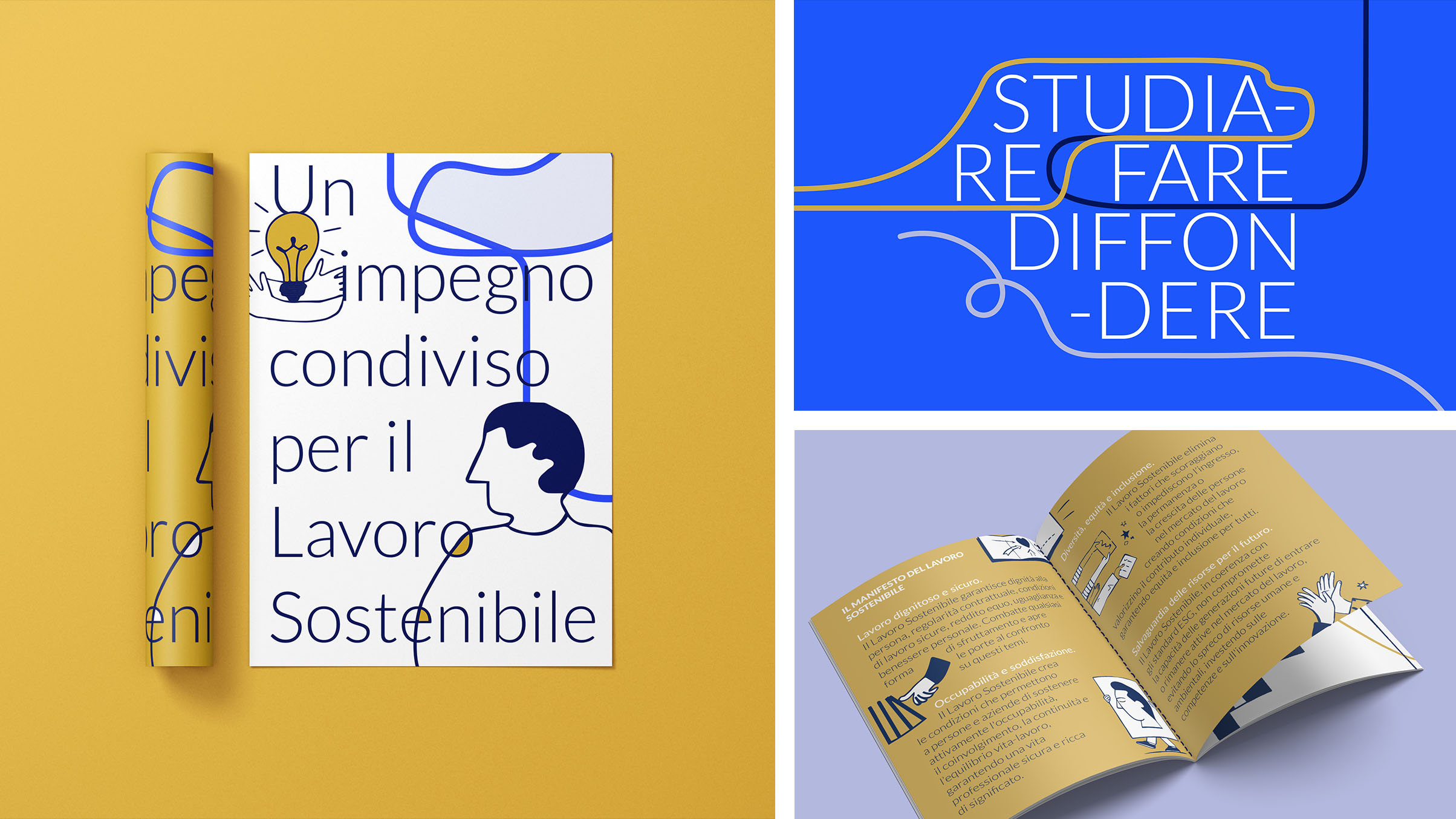

The Gi Group Foundation engages in various activities, continually seeking to provide new meanings and opportunities for Sustainable Work as its corporate purpose. It begins with the workplace inclusion of the most vulnerable individuals, tackles the young NEET issue, addresses gender inequalities, and delves into the world of art. In this case, CBA opted for a brand identity that was distinctive in terms of color, language, and typography but still identifiable within the visual universe of Gi Group. In this case, the world of work is a clear and common thread that sees the Foundation and the company working together in complementary ways. In addition to the visual identity, we developed the brand manifesto of the Foundation.

The case of the Marco Fileni Foundation is different. CBA has been working with the leading poultry farming brand in Europe for years, but the foundation created by the family has entirely independent and autonomous goals and values.

CBA approached the rebranding of the Marco Fileni Foundation by starting with an in-depth understanding of the person the foundation is named after, who passed away prematurely. This understanding was gained through interviews with his friends and family. From these interviews emerged a clear portrait of Marco Fileni, where the human aspects of his personality were described almost unanimously, as if it were a coordinated chorus of voices. From this, we derived the values and mission of the Foundation, which will guide its activities and decisions from this re-founding moment. Based on these guidelines, CBA developed a new, fresh, and vibrant visual identity, with a language capable of attracting and communicating with younger audiences.

In these projects, we have experimented in the field to understand the high emotional and ideal potential that exists within these organizations: entities that, free from market-driven logic, dedicate themselves to lofty, universal themes with significant impacts on both society and the individuals involved. The key for us lies in the analytical approach applied to each brief, coupled with the empathetic approach aimed at truly understanding the origin stories, and then presenting them in the best possible way, creating brands capable of conveying all the complexity and beauty behind the scenes.

Francesco Saviola, Research & Brand Strategist at CBA

It is one of the most recent evolutions in the history of branding and, at the same time, one of the most exciting ones. The awareness that a brand needs to be relevant internally as well, not just directed towards customers and external audiences, has changed branding strategies and, more fundamentally, the strategic thinking underlying them, leading to the emergence of new practices, methods, and tools.

In many cases, the implementation of employer branding strategies leads to increased effectiveness of activities belonging to the “traditional” sphere of branding, with positive impacts on crucial factors such as productivity, customer experience, and brand perception.

These are topics that we have recently encountered during the development of Employer Love Branding, the editorial project by CBA Italy dedicated to employer branding and specifically to the enhancement of the brand in the relationship between companies and employees, launched last February.

It has been a journey in which we sought to understand how to define and elevate the role of the brand in internal engagement, attempting to grasp how the application of the principles of an Employer Love Brand can bring real benefits to companies.

These are far from academic discussions, especially in a historical moment where companies are daily confronted with a dynamic and challenging labor market, where attracting, acquiring, and retaining talent has become increasingly difficult. Employer branding becomes an essential weapon within this context, leveraging various spaces, languages, and tools.

Among the most modern and widespread tools, both in Italy and abroad, are Corporate Academies.These are structures of continuous and permanent training within companies. There are different types of Corporate Academies, primarily based on their organizational aspects. The main distinction lies between 100% internal Academies, open only to employees, and entities that originate within companies but are also accessible to external individuals, whether potential talents, suppliers, stakeholders, or simply those interested in the knowledge offered.

Corporate Academies contribute to several objectives. The first one is, of course, specific training, through the dissemination of valuable technical and non-technical content. Alongside this, there is the function of positioning and awareness towards the external world of the company, especially when it comes to “open” academies. Careful strategic planning and coherence of the Academy generally contribute to strengthening the brand’s positioning in the target market, as well as becoming an important part of the company’s reputation.

However, the impact that Academies can have on employer branding-related topics is also significant. This includes aligning corporate values with employees’ personal values, defining codified approaches and methods, creating new spaces for sharing, and becoming a powerful lever for attracting potential talents and retaining those who are already part of the company.

Certainly, from a strategic standpoint, the design and implementation of an Academy (or University, as they are sometimes called) raise questions about brand architecture, particularly regarding the relationship with the Corporate brand. Based on our understanding of the target market (which led to the completion of one of our recent projects, the branding project for Lynfa, the Corporate Academy of Gruppo Sella, we have identified three main scenarios:

In the first scenario, the familiarity between the Academy and the Corporate brand is evident and explicit, highlighting a strong alignment in positioning between the brand and its Academy. An example of this is the Mastercard Academy.

The second scenario is a hybrid one: the Academy carves out its own space of independence from the Corporate brand, sharing either visual/textual identity or the content covered, but not both. A typical example of this is b*right, the corporate university of GiGroup.

Lastly, the third approach is when the Academy becomes a separate entity, with its own independent positioning, visual identity, and communication. An example of this scenario is Go Beyond Academy, the school of Sisal dedicated to innovation and the startup community.

The choice among these different options ultimately comes down to strategy and must align with the company’s objectives, whether they are overall goals or related to employer branding. For instance, if the primary need is to strengthen the values connection with employees, the first scenario will be the most effective, both in terms of brand architecture and in the content and organizational choices of the Corporate Academy.

On the other hand, a hybrid approach may be more suitable in cases where the need for employer branding is to convey the existence of “free spaces” for knowledge sharing, innovation, as well as personal ideas and ambitions. This scenario is ideal for showcasing talent and finding new ways to enhance its value.

The third scenario, Self Standing, being the most independent from the mother brand, proves particularly fitting (as in the case of Lynfa) in situations where the employer branding objective is to be open to the outside world, such as talent attraction and acquisition.

Fabio Pisanu, Communication Strategist

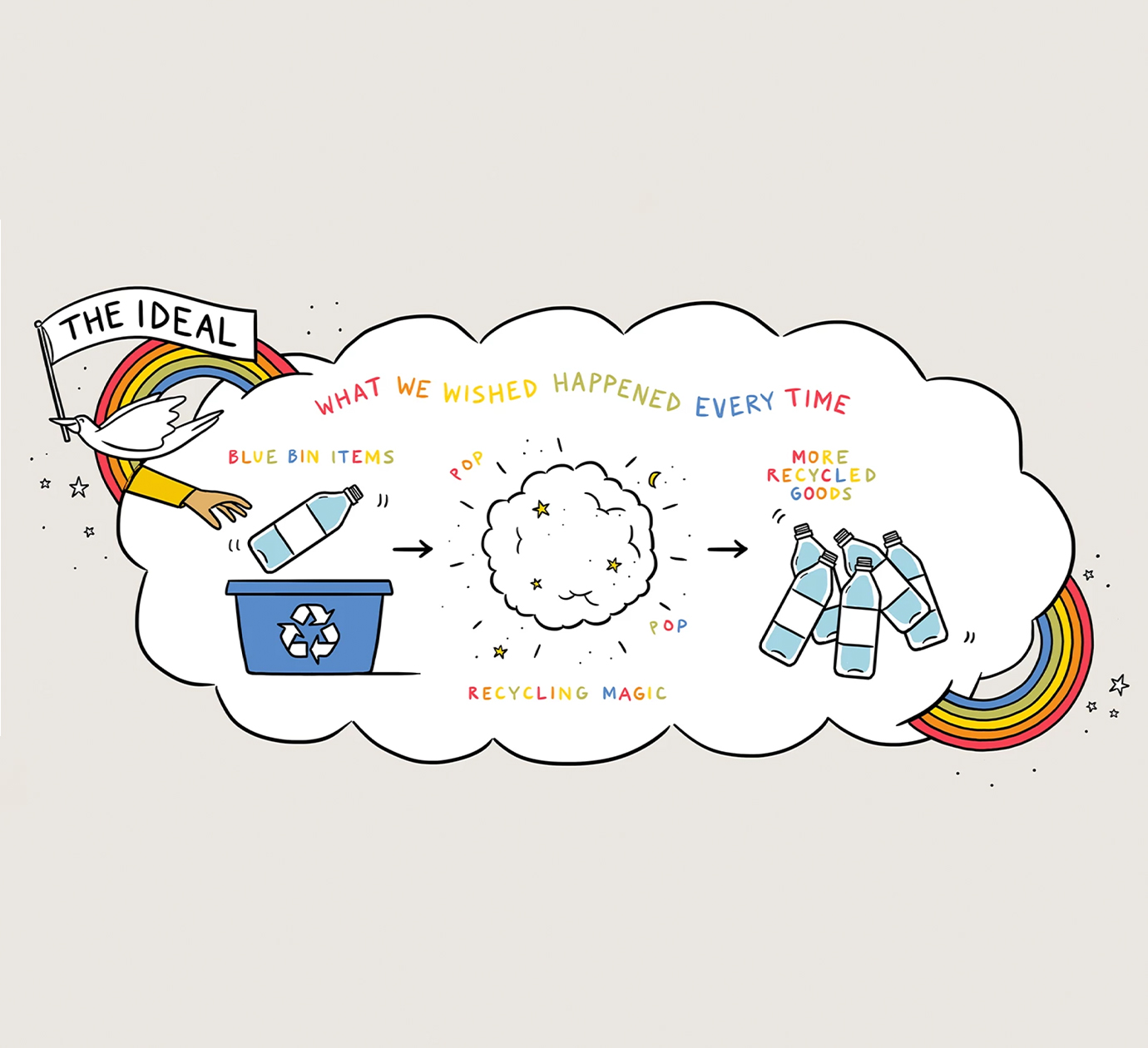

For CBA, talking about sustainability has always meant starting from the facts and working with brands to identify their concrete commitment. Acting as a brand activist is a serious matter because consumers have become increasingly aware and demand greater transparency.

So today, we are happy to tell you more about our journey with Fileni. A project focused on their Purpose, Vision and Mission, which has led the brand to be the first B Corp in the world in its sector.

Thanks to the company’s firm belief in its choices in pursuing sustainable innovation for more than 20 years, we have reached this crucial goal. They have worked through tangible initiatives, taking all the steps necessary: organic farming, the production and purchase of electricity with a Guarantee of Origin, antibiotic-free breeding and a Sustainability Report covering the entire supply chain, with the final goal of Benefit Society certification.

Facts first, then. A brand must equip itself with a strategic plan for two fundamental reasons: to guide future choices coherently and to communicate (internally and externally) their long-term project. CBA enters here through a strategic project divided into five phases, involving the company board and the first line of Fileni management.

In this newly formulated Purpose, Fileni completely takes on and practices the concept of Regenerative Culture as a common good for all and the new generations in particular.

Today Fileni, with a well-grounded purpose shared by all employees and members of the supply chain, is the standard-bearer of an ethical approach to production and consumption. Their method gives life to a new business model, which enhances the territory sustainably and with profit.

Brand activism is nothing new. The importance of having a clear purpose has been extensely discussed for decades. Aligned with this foremost intention comes the necessity to define which causes a brand wants to support, meeting the demands of an audience that craves for more humane and coherent stances. Nowadays, brands have to stand for more than just profit: they are expected to contribute to building a better society.

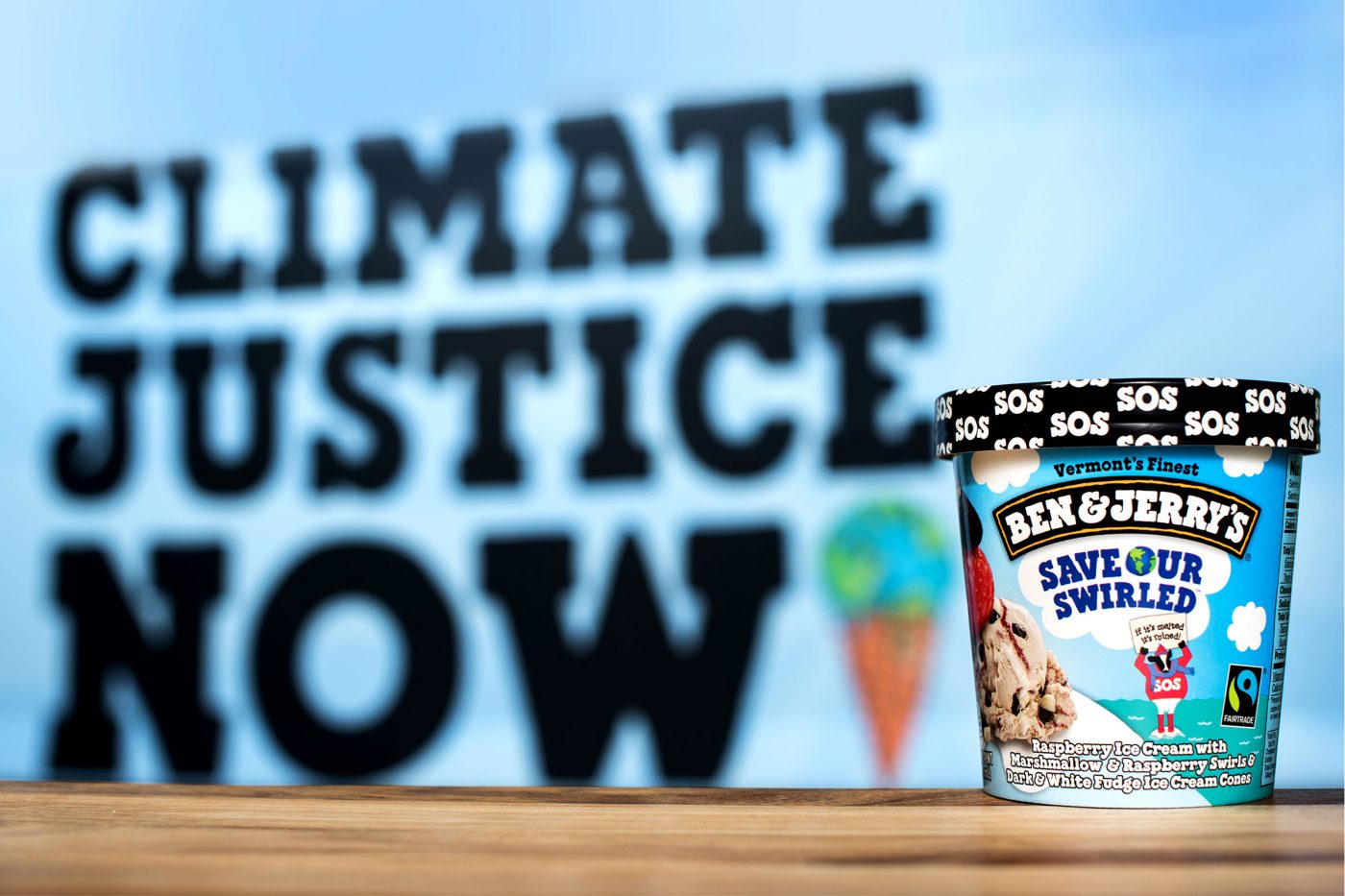

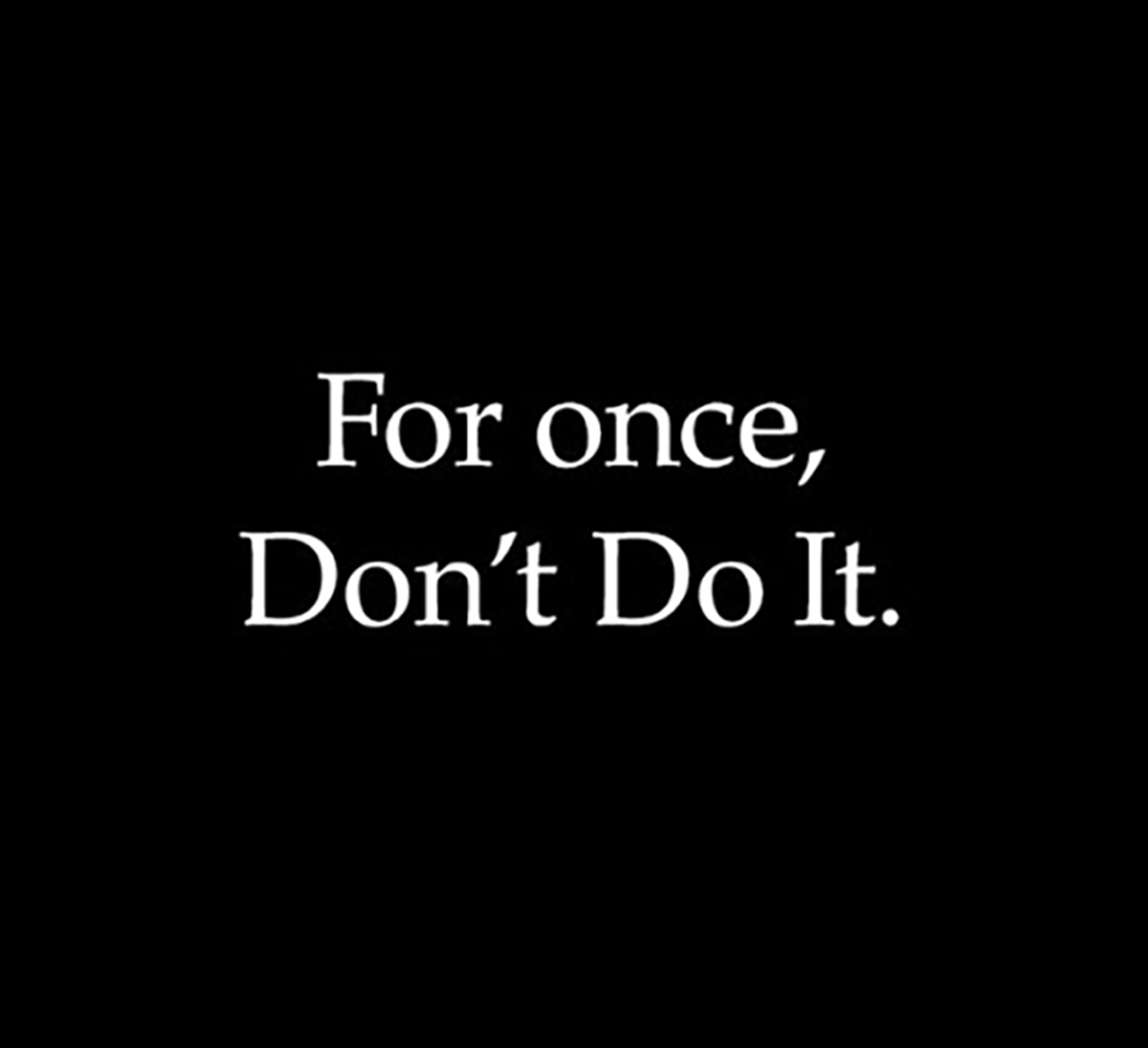

The uncontrolled pandemic, the polarization of society, the stronger presence of social media and the growing cancel culture have boosted the game. What used to be an opportunity, is now a requirement – at times, essential for the survival. Brands have to build a positive impact territory; the mere position of trading goods and services, coupled with the neutrality towards relevant issues such as racism, gender, feminism and environment, is no longer a strong enough offer. Not taking a stand may give rise to the impression of consent, while stating an opinion can be seen as hypocrisy – if the talk is not followed by concrete actions, aligned with the brand’s DNA – depleting the brand’s value.

Thus, brands must take a clear stance and genuinely commit to one or more causes to remain competitive. The challenge faced is how to approach it constructively, being faithful to the brand’s values and not sounding self-serving, besides being careful to minimize the risks of boycott in an increasingly demanding environment where one slip can be fatal.

Bearing this challenging and intriguing setting in mind, we propose some reflections to help brands understand the different possible types and levels of activism, the risks and benefits of speaking up. Paths that, when followed with truth and transparency, can lead to a real and long-lasting commitment.

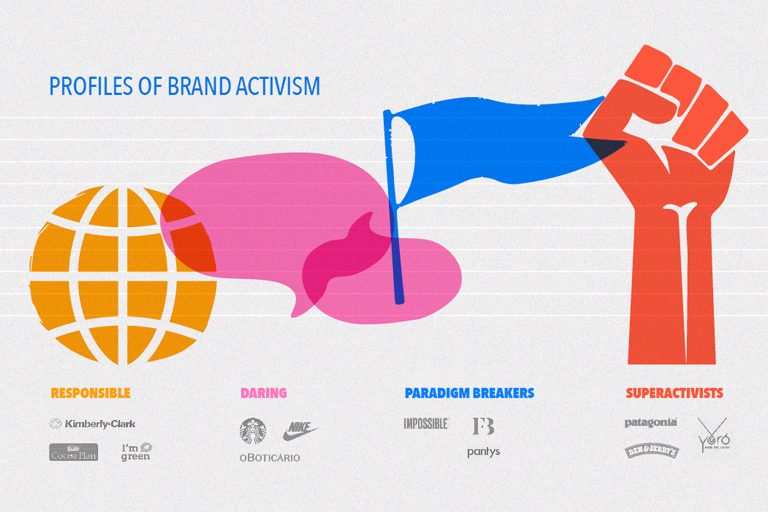

We all know, there is no single way to engage, and there is no right or wrong. We suggest below an ‘activism profile classification’ based on the brand’s DNA and its intended relation with its stakeholders, more than on the company’s size or category. Here they are:

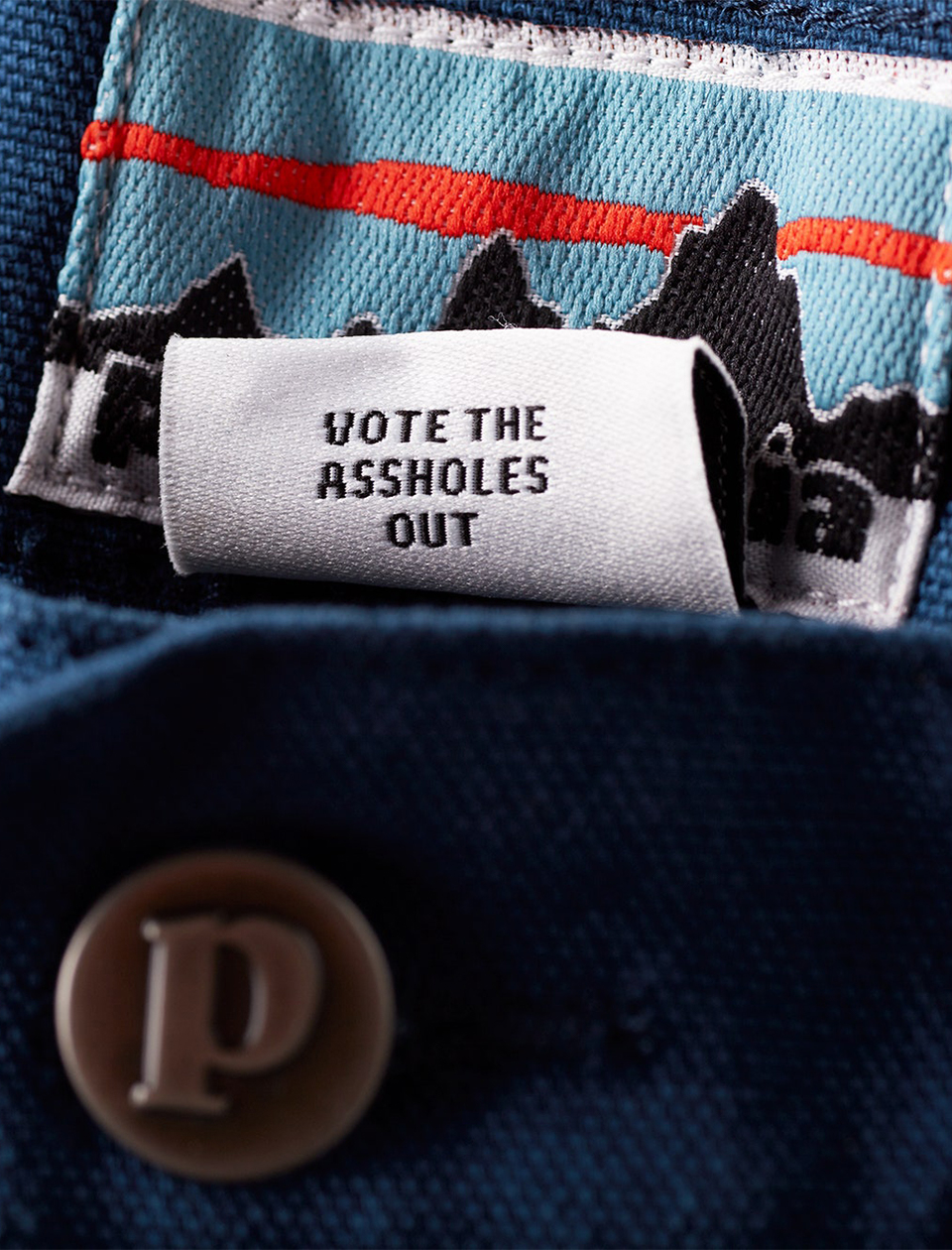

Brands that are activists since foundation, deeply engaged with causes related to the brand’s core values, and supported by the founding partners or CEOs themselves. They believe that action speaks louder than words, and they take to the streets with its public to be heard and actually aim to achieve social change. They create a strong emotional tie with its fans, so much that they usually become brand ambassadors.

Innovative brands, pioneers in their respective businesses since foundation. Their own core products or services are their flags, since their proposal is to change patterns and break a category status quo. They usually forge an emotional bond with their consumer base, for meeting previously unmet needs.

Brands that are not as openly and constantly engaged as the Superactivists, but that still defend their values and causes coherently. They lead engaging actions and are agile taking a stance on current issues that connect to their values, joining the conversation and encouraging discussion, even if not everyone agrees.

Companies that take corporate actions that benefit causes (foundations, social responsibility programs, donations), usually signed by the masterbrand. The brand activism is not evident on their pillars or sub-brands communication channels. It is a more traditional – and discreet – engagement, without generating conversation or controversy – but still a stimulating one, mainly among their consumers. Besides taking corporate actions, these companies are aware that their product portfolio must be aligned with sustainability and latent requirements to promote actual change – in society and in the planet.

The insight was written by CBA B+G, read the original article here.

What profile of brand activism do you associate your company with?

What is the purpose that guides your responsible choices?

Would you like to know our methodology for defining and acting on purpose in organizations?

Contact us at: [email protected]

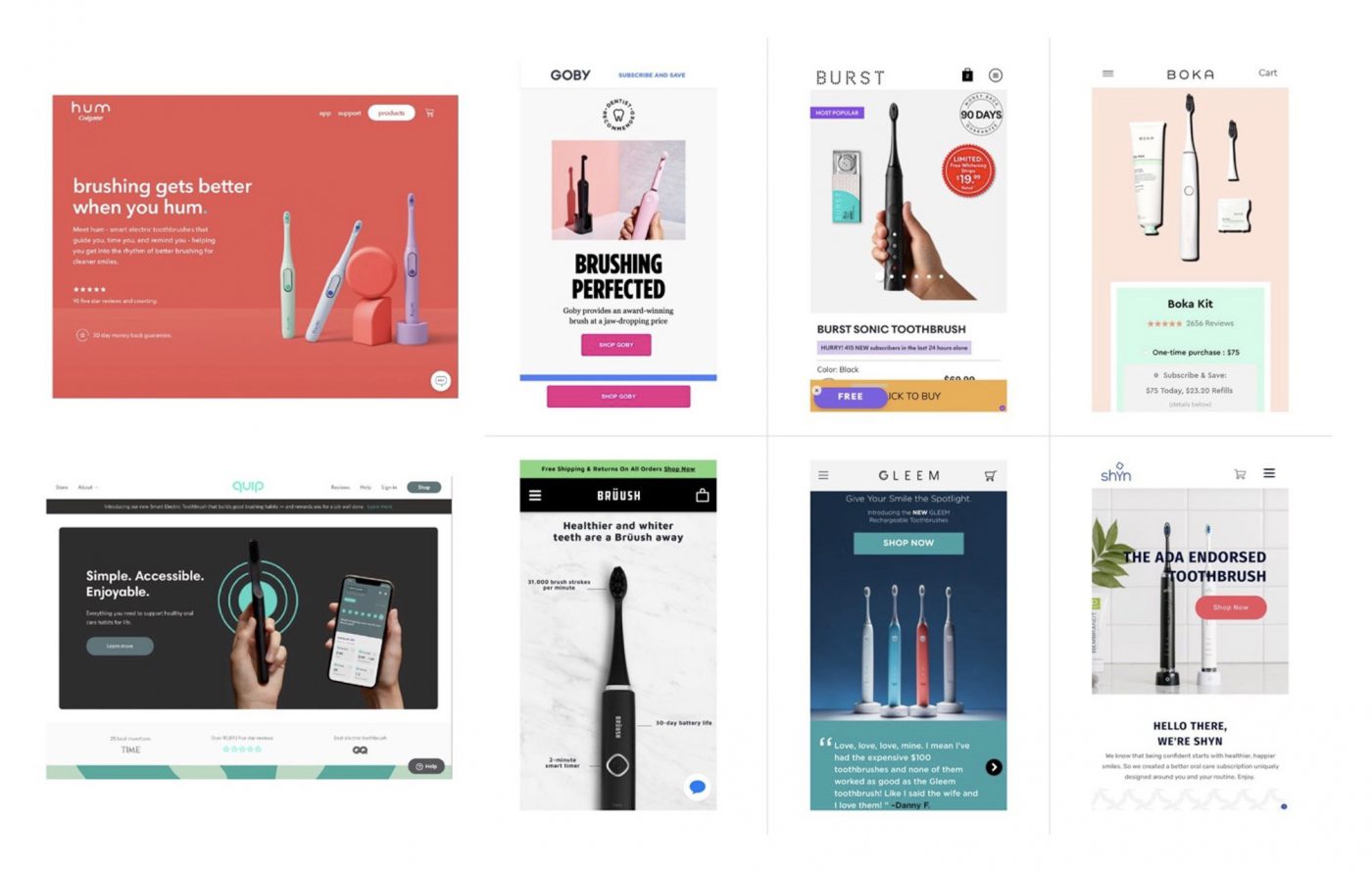

In May 2019, our IMG report Direct to Consumer revolutionappeared, dedicated to DTC brands, native digital players who, by disintermediating the value chain, are redefining the frontiers of certain specific industries.

From then on, many things have changed, and the DTC phenomenon, accelerated by the digitalisation attained during the pandemic, has affected the rules of the game in various sectors, even in Italy.

Just consider what has happened here with us over the last six months:

The reason why even established brands are making their moves – no longer timidly – in DTC can be explained in terms of three fundamental objectives

However, these three forms of leverage, absolutely crucial for consolidated structures, are no longer something innovative for consumers, who in the meantime have developed new expectations: the bar has been raised, to the point that the public does not just desire, but positively expects, an impeccable customer care, excellent design, faultless wow experiences, a website and social media packed with entertaining content, backed up by an exciting community.

Many, above all at an international level, have interpreted this moment in history as a wave to be surfed, a golden opportunity for standing out on the market. But the result is exactly the opposite. In other words, there is a standardisation in terms of what is offered, created by the desire to follow “DTC laws” to the letter: considering a product category, such as electric toothbrushes, we see that the market is becoming saturated with identical products, with the same business model, the same design, the same communication strategy and tone of voice. We are witnessing a progressive uniformity of supply, and consumers find it difficult to find their way around, because all brands are responding to the same need in exactly the same way.

We are also seeing an increase in CPA(cost per acquisition), precisely because the powerful model based on social media communications, adopted early on by DTC brands, has become the principal sales channel for most DTCs, pushing costs sky-high.

There is yet more: DTC brands, in their DNA, have a specific response to the needs of a niche target. This “obsession” with a specific niche, something that for some time has denoted these brands’ power and success, is now beginning to crumble: by now, the niche has beenreached, if not by the brand itself, by one of its competitors, and growth, in terms of volume, has become very hard to attain, unless by applying new strategies for expanding the portfolio and/or services.

What is the added value that big brands can bring to this by now saturated market?

The entry of big brands into this market could make waves and bring some interesting innovations at a moment of notable difficulty for the smaller players:

BUT… There is still a big BUT.

Both DTC brands and big brands will soon find themselves fighting a shared enemy…

Having eliminated the old intermediaries is no longer enough. New middlemen are appearing and they will steal the privileged position of direct contact with consumers. Just think of the inexorable growth of voice shopping.

In an ever-nearer future, voice assistants will choose for us, according to our purchasing habits, but also strongly promoting proprietary brands, or those willing to pay in order to be selected automatically. This will lead to the arrival of incidental loyalty, in other words, the birth of a fidelity linked to decisions over which the user has no control.

So, the fight for disintermediation continues…

The history of inequality between men and women is as long as “the history of man” (sic!). Yet today, we are seeing significant changes and signs which seem to go beyond the symbolic mimosas of 8 March, both at the level of political movements and at the cultural and economic level, with the activism of the more committed brands. On the front of women’s civic engagement, recent years have seen the birth of various phenomena such as the #MeToo movement, which arose in the United States against the sexual harassment and assault of women, later followed by other movements such as “Non una di meno” [“Not One Woman Less”] in Italy, or viral events such as flashmobs protesting gender violence organised by Chilean collective Las Tesis, which has now spread around the world. (Las Tesis – video YouTube).

What is being created in parallel in the business world is a new sense of awareness and a new approach by brands in terms of gender and women’s needs, addressing the needs of those who do not have the time, desire or ability to take part in these new feminist movements but who identify with and support the cause.

As trend researchers, we have come across numerous examples of brands taking a new approach to gender issues.

They highlight the idea of women’s empowerment by coming into people’s daily lives with services and products designed for women and featuring messages and actions which promote their self-determination and which help to remove taboos around issues such as menstruation and menopause.

In the world of business and brands, we all remember the example set by Dove, a forerunner of the issue of body positivity with the “Dove Self-Esteem Project”, a campaign which even included workshops for schools on the acceptance of one’s own appearance. Many large corporations followed suit, and we can see two different levels of change which have taken place.

The first sees more well-established brands starting to address women in a different way, trying to somehow “make amends” for what happened in the past (sexist and stereotyped representations which limited women) with campaigns and individual initiatives; the second is more bold and innovative, and is championed by many newer brands who make women’s empowerment their very purpose, their raison d’être.

An example of the first approach from the field of music is the collaboration between companies such as Smirnoff and Spotify, which created the equality-themed “Playlist Equaliser” tool, ensuring that both male and female artists are represented in equal measure, contrary to what still happens in the music industry (amongst others), which is still largely dominated by men.

In the world of telecoms, Vodafone created a short film entitled “Raising Voices” which goes in the same direction by addressing the stereotypes and inequalities that determine the horizontal segmentation of the labour market, using the voices of child actors who wonder “why are all IT specialists men?” and “why are almost all superheroes men?”. Over the years, even several major brands have “learnt their lesson” by adopting the issue of empowerment, such as Nike with their “All Woman Project”, which collected the stories of New York’s female athletes: women of all shapes and sizes, all races and ethnicities, in the name of inclusiveness, their common trait being their “toughness” as women who are different but who have made it, celebrating their exceptionally unique and unmatched diversity (https://www.nike.com/us/en_us/e/cities/nyc/all-woman-project).

Then there are new brands which are created with a specifically female target market and an even more inclusive approach; often markedly feminist, they make empowerment their brand mission.

In sportswear, there are brands such as Outdoor Voices which perfectly represent the theme of inclusiveness, bringing their purpose to life: “We’re on a mission to get the world moving. Moving your body generates endorphins. Endorphins Make You Happy”. As such, they represent a world where sport is for everyone, male and female, and not just for athletes, distancing it from the traditional idea of sport being a solely performative and competitive arena. (https://www.outdoorvoices.com/).

A classic example of this in the underwear sector is the crisis that Victoria’s Secret, the biggest player on the US market, has been suffering in recent years. Its market share has dropped from 33% to 24% in 2 years, and it closed 52 of its shops in 2019. New players are popping up in its place: brands such as Lonely, which selects models with more curvy and realistic physiques than the picture-perfect “Angels” used by VS, making it a brand with a strong and genuine identity and an unusual photographic style featuring stretch marks, body hair and models who seem much more relatable and human than the top models favoured by VS. Victoria’s Secret’s problem lies in the underlying reasons for its foundation, namely the fact that in 1977, businessman Ray Raymond wanted to create “an underwear shop where men could go to buy something nice for their wives”. This model, which focused on the stereotyped aesthetic of the top model, aimed at meeting the needs of the husbands rather than the actual end users, is exactly what is being challenged nowadays. Agent Provocateur – a brand with an eloquent name – was also famous for its extremely provocative adverts, until it filed for bankruptcy, was acquired by Four Holdings, and is now rethinking its identity entirely: “Lingerie doesn’t have to be serious. It should be fun and playful and empowering” – this is the new approach from Agent Provocateur’s creative director.

In the same sector, brands whose unique selling point is their comfort and practicality for end users are starting to flourish. Thinx, for example, whose period underwear offers a range of female underwear designed especially for that time of the month, with an “absorption capacity equal to that of 4 tampons”. Their site not only showcases the product, but is filled with content about women’s health and speaks an empathetic language, aimed at normalising the topic of menstruation in the everyday life of women (and men).

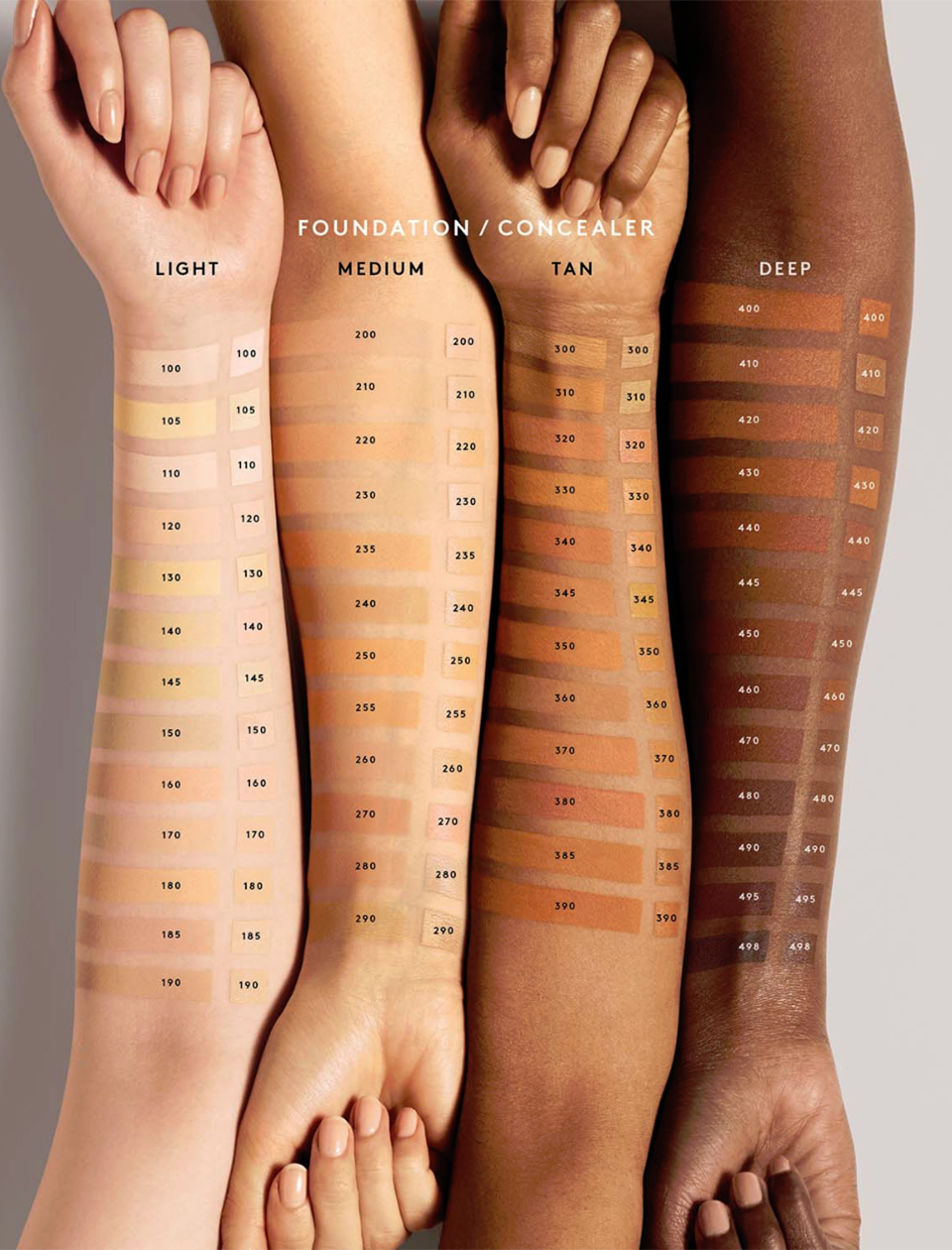

The beauty sector, too, has examples such as Fenty Beauty by Rihanna, the make-up brand created by the singer in collaboration with the giant LVMH, whose entire identity lies in the idea that putting on make-up no longer means applying a uniform to standardise beauty, but rather a creative tool which can be used to express yourself, accessible to all and inclusive as it is designed for each and every skin tone and complexion.

AW LAB itself, in conjunction with CBA, has created the new retail brand “HERE”, a store just for women which is also a platform for events and workshops aimed at providing young women with the tools to learn, to be themselves outside of the pre-packaged models, and to fulfil their potential in the professional world, especially within the fashion system. What’s more, this is not the first time that AW LAB has organised initiatives like this one: last year in Milan, they organised the #WMNStogether project, where 6 talented ambassadors were invited to hold all-female talks, workshops and DJ sets to show young women once again that superheroes can also be female, that they can be whatever they want and that they can make their dreams come true. In this sense, AW LAB has closed the circle on both levels, moving from a single initiative to the creation of a fully-fledged brand like HERE, which is entirely dedicated to the personal development of young women.

Francesco Saviola, Strategic Designer at CBA

The theme of sustainability is becoming more and more pressing in every productive and economic sphere, touching also different areas, from the attention to the environment, to the social and economic impact of the single choices of the brands. In this scenario, design takes on different roles: from being synonymous with the production of increasingly sustainable (and at the same time profitable) products and services to a true holistic and systemic approach to design, u0022sustainableu0022 in its own premises, regardless of the result that that particular form of u0022designu0022 can produce.

Needless to mention, in the first case, the numerous examples of products and services that use materials, processes, production techniques that have little impact on the over-exploitation of natural resources and that, at the same time, do not see their profitability undermined.

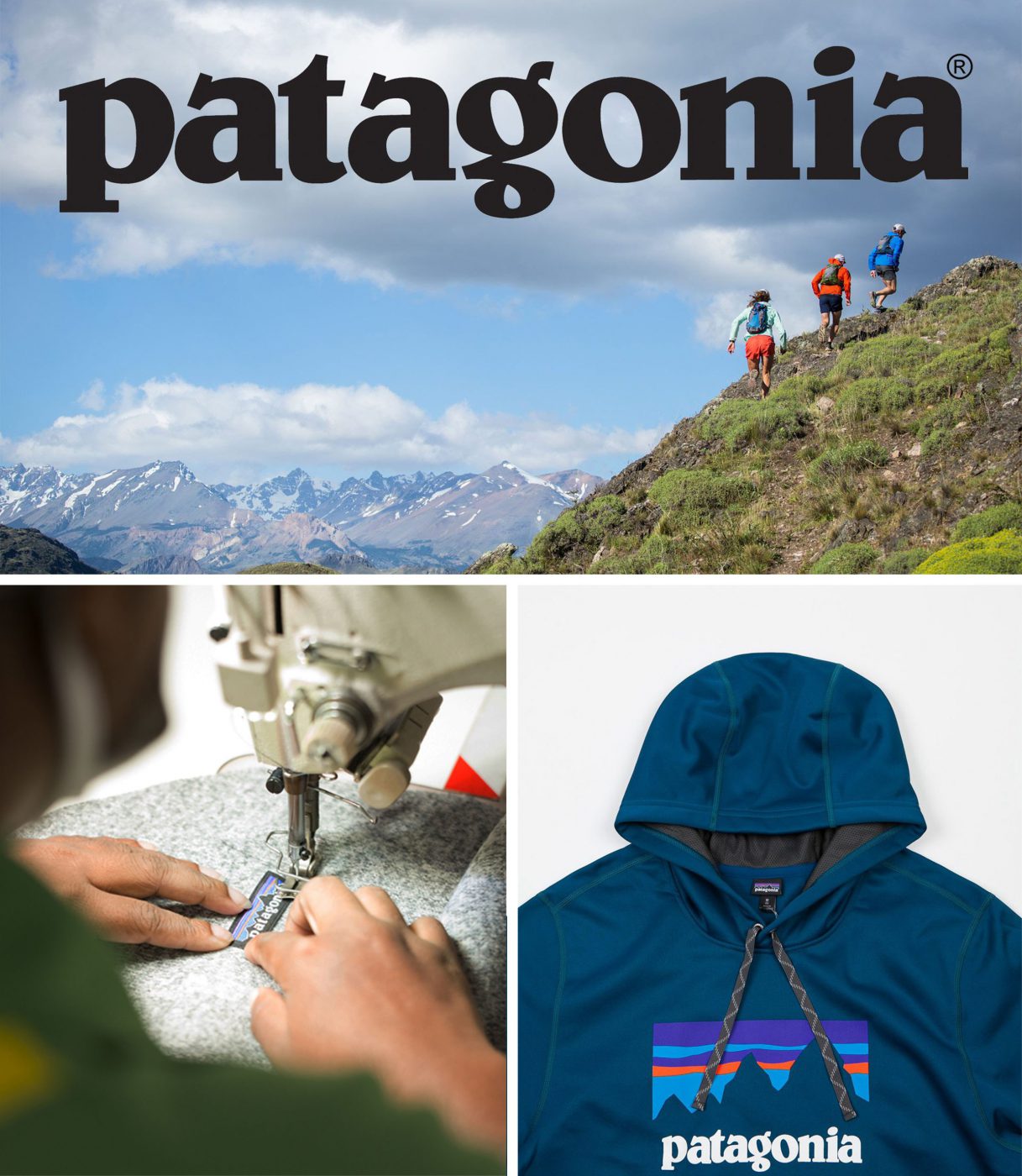

Patagonia is one of the most famous brands in this direction: born in California in 1972 from a small company that produced equipment for climbers, today it produces and sells clothing for sport, all in a sustainable way. Since 1994, for example, all Patagonia cotton garments are made from 100% organic cotton, instead of the one grown with massive use of pesticides.

Even Apple, although at first glance in our imagination may seem far from the idea of “sustainabilityu0022, has made a serious contribution signing an agreement in 2015 worth $ 1B with First Solar, the largest park builder in the United States. Using their technology, Apple is able to power its stores, offices and data centers in California with solar energy.

Another well-known example is Lush Cosmetics, a brand of completely natural beauty products who invoices about $ 1B per year. Since its inception, Lush has been dedicated to producing eco-friendly products and practices. Their success and their dedication to respecting the environment are paving the way for other beauty companies, increasingly dispelling the myth that u0022being too sustainable costs too muchu0022.

But the combination of design and sustainability has taken a step further: today it is no longer u0022justu0022 devoted to the production of sustainable products (or in their final result, as in the case of Patagonia and Lush, or in its production process as in the case of Apple).

If it is true that design has become increasingly synonymous with a design approach even before the visual and concrete result of a creative work, even “sustainabilityu0022 is becoming increasingly synonymous, first and foremost, with a design approach.

We are talking about a systemic approach that is “sustainable” by nature, at the very moment in which it proves capable of taking into account the entire network and the context in which it is immersed. An approach that considers challenges in a holistic way, focusing on solving problems at a higher level, making much more radical changes possible that affect changes in consumer habits and behavior.

It is therefore a question of broadening the gaze to understand how to respond to a specific need for well-being. Designing product and service systems within which companies, consumers, institutions and all social actors live together in respect of their mutual interactions.

Think for example of the phenomenon of car sharing: the holistic and systemic design approach with which it was designed, has turned its attention to the broader concept of mobility, exploring it in all its meanings, even before moving towards the design of less polluting vehicles.

In this perspective, u0022sustainableu0022 design tends to reason not only in terms of product and service but in building profitable relationships and new partnerships to tackle problems differently.

Through a systemic approach to the resolution of needs that companies – as always – cultivate the ambition of wanting to answer, it is possible to imagine u0022new worldsu0022 by designing interactions with users never seen before.

Francesco Saviola, Strategic Designer

A growing number of brands have started talking to the world about “illnesses” (and, in turn, cures) using a completely new language and approach.

This is the case for Keeps, which deals with the issue of baldness (the bitter enemy to all men, especially the younger ones) with an ironic and uninhibited tone. Having a problem is no longer an embarrassing thing to be hidden. The real embarrassment, today, lies in not doing anything to fix it. Hims is of the same opinion, a company which is helping to break the taboos surrounding men’s sexual health, using irony to allow them to talk about their issues. Photos of a cactus, at first shown in its full vigour, and then withered, are the not so concealed metaphors used to present the range of products for erectile disfunction. Lastly, Queen V wants to put an end to the stigma surrounding female hygiene. With an easy 3 step process, it offers products to achieve, maintain and consequently enjoy one’s health freely and without a care in the world.

The items sold by Keeps, Hims and Queen V are not so different from those of their many other competitors found on the shelves of chemists and supermarkets, in terms of “products”. The difference is rather the way in which they present themselves and communicate. For example, the brand images that use unusual colours, fonts and visual language for pharmacological remedies are the ones that will catch your eye straight away.

But it doesn’t stop there. The (successful) undertakings carried out by these brands goes well beyond simply embellishing an already existing product. The aesthetic depiction of the brand and how it is advertised are just the tip of the iceberg. The real difference lies in the definition of the illness (or the physical or psychological “issue” being faced) presented in the image of these brands.

The first change in perspective took the form of responding to a specific issue not with a one-off intervention but with a course of treatment. This is often used for incurable conditions, necessitating the repeated use of drugs and an often-radical change in one’s behaviour.

The solution is not a miraculous cure that you take as soon as the problem appears, but a course of treatment. This may consist of pills, ointments or syrups, but these are to be taken according to a dosage that is adapted to the individual and the current status of the illness and should be accompanied by behaviour and good habits that, altogether, make for a new lifestyle.

To allow the user to take immediate and regular action, without stressing and turning their day-to-day life upside down, these new brands offer a subscription-based business model. Care of personalises its vitamins and supplements packages based on the needs and preferences of the user, which are conveyed through an online questionnaire. The products are then regularly delivered to their home according to their requirements, which can be edited online at any time.

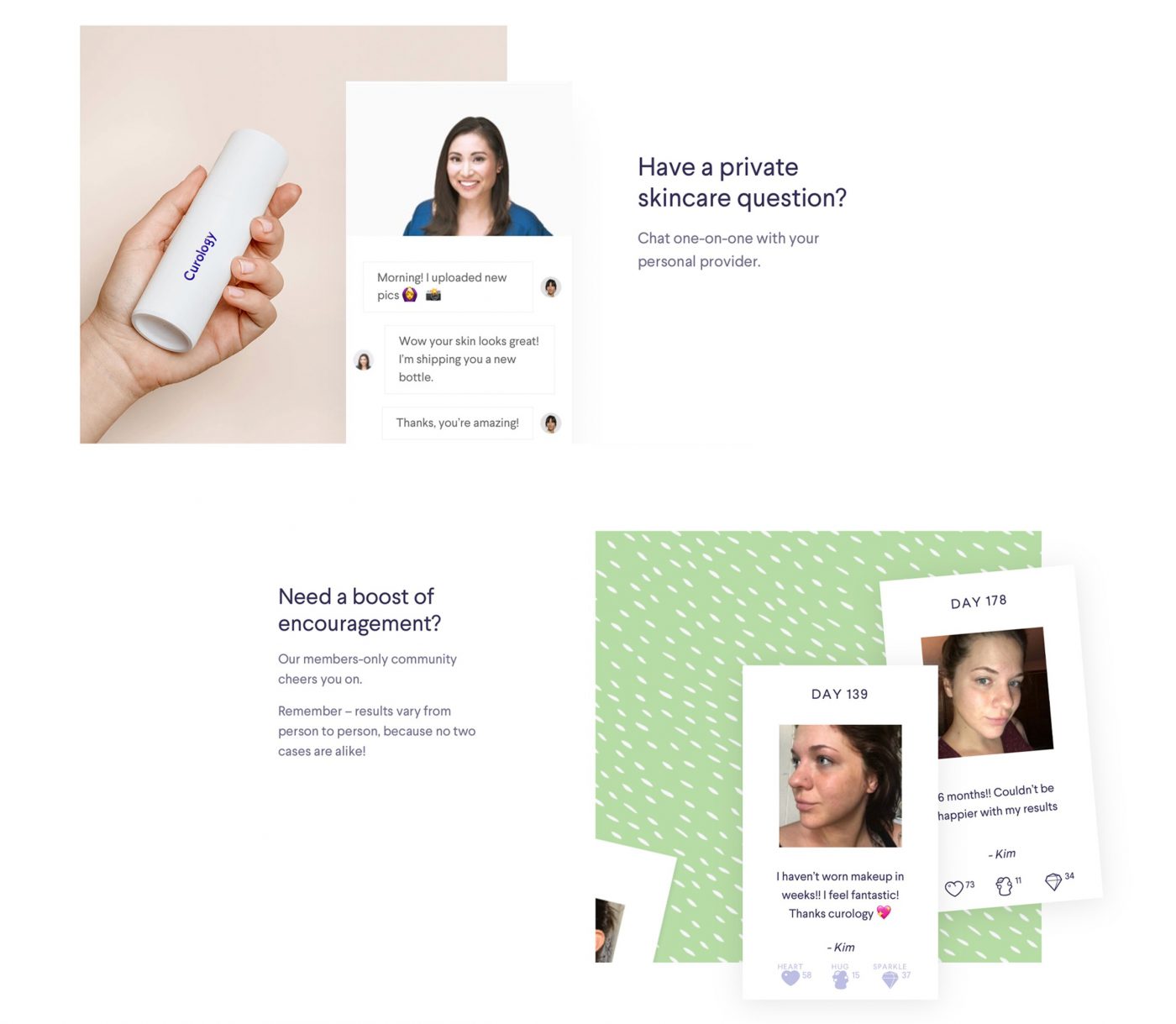

Curology goes a step further in tailoring their skincare creams to the needs of individuals. This is achieved by putting each user in contact with a professional who can identify and combine the right ingredients, creating a lotion that is right for them. In order to avoid miscommunications, the lotion takes the name of the user. The professional then tracks their progress.

Another way in which users are looked after and guided in their daily life is through specially created content that educates consumers, advising them about good behaviour patterns, debunking myths and keeping them up to date with news and initiatives. By signing up to receive Callaly’s tampons, you can also read their journal, which includes special guides, interviews with experts, stories from real women and information about social initiatives.

The second crucial change in perspective came in considering your health no longer as a source of embarrassment but as something that you can talk about. The brands tune into their users and no longer offer them a mask to cover up their problem and pretend it doesn’t exist. Quite the opposite, they want to help people who are suffering talk about their condition, so they see that they are not alone, drawing comfort and strength from the stories of others.

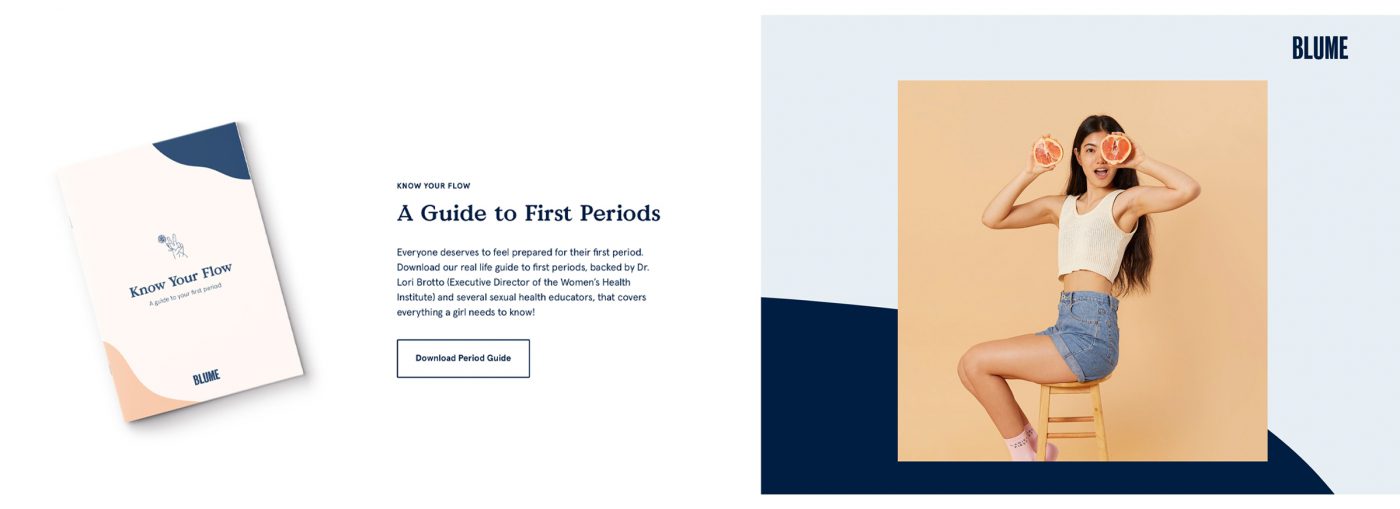

The irony used by Hims to normalise and tackle issues is common across many brands. Meanwhile Blume adopts a more empathetic and personal approach. The two sisters who founded this company have experienced first-hand the distress of not being able to find effective yet convenient products for intimate hygiene and body care during one’s teenage years. That’s why they used their own experience as a springboard and, also taking inspiration from the stories of other girls, created what they call a “gang” of products for which their users’ stories act as the best testimonials.

Having broken the ice and opened up a conversation, real communities have been formed around the brands. Genneve presents itself more as an online listening clinic than an e-commerce portal for menopause products. The type of conversations that it opens up to its users take every possible form, from one-to-one discussions with an expert, to the forum where you can talk with other members of the community.

The last change in perspective is related to leading users to transform their fear into freedom. The real aim of the above-mentioned brands has been to allow their consumers to be free to live their life, without worries or fears about their health. When brands tackle conditions that come up at a certain time in their users’ lives, shaking up the norms they were used to, they need to know a way to tell them that it is possible to carry on living. Not only is it possible, it is also wonderful and fun.

Queen V is launching an ode to freedom, with gaudy colours and photos of real, happy women. They want to give all women the freedom to “say the word vagina without getting embarrassed” and to stop worrying about their health and hygiene, because it is possible to deal with it anywhere, any time. Hers is another brand that creates content and offers online prescriptions that put women back in control of their health. Convinced that no one can do it better than themselves, they help women to get to know their own body and meet their needs. Thinx dispels any uncertainties surrounding periods and looking after your underwear during your menstrual cycle, using real life simulations. User influencers demonstrate this further, as they give details of their days on social media.

The brand image of these new trademarks gives us with a wider view, which goes beyond simple packaging and slogans: it is the illness that needs new approaches and a new language, not the pharmacological products. Through a change in perspective, the brand acts as a beacon, able to direct the way it comes across in all circumstances, from its visuals to the business model.

Marta Fontana, Strategic Designer at CBA

The indirect brand economy which spanned more than a century (from 1879 to 2010) was based on a tried and tested process. Brands passed through various intermediaries, beginning with the advertising agency, via publishing houses and distributors, and coming, at the very end, to the consumers.

Dominating the distribution chain thus meant dominating the market.

Now, the growth resulting from digital distribution is undergoing a shift towards the direct-to-consumer formula: the existence of the cloud allows never-before-seen ways to enter into contact with the market, pushing brands to ever increasingly connect directly with consumers.

What are the ingredients for this new winning formula? By taking advantage of the transformation in the supply chain panorama which is centred on information technology and the net, native digital players (mattresses, kitchenware, luggage and even sheets, to name but a few) are capable of proposing a higher-quality product and service experience at a quarter of the typical price. But how?

The New York brand Care Of presents its clients with a thorough 48-question survey before putting together a proposal for supplements which is suited to their specific requirements and/or deficiencies.

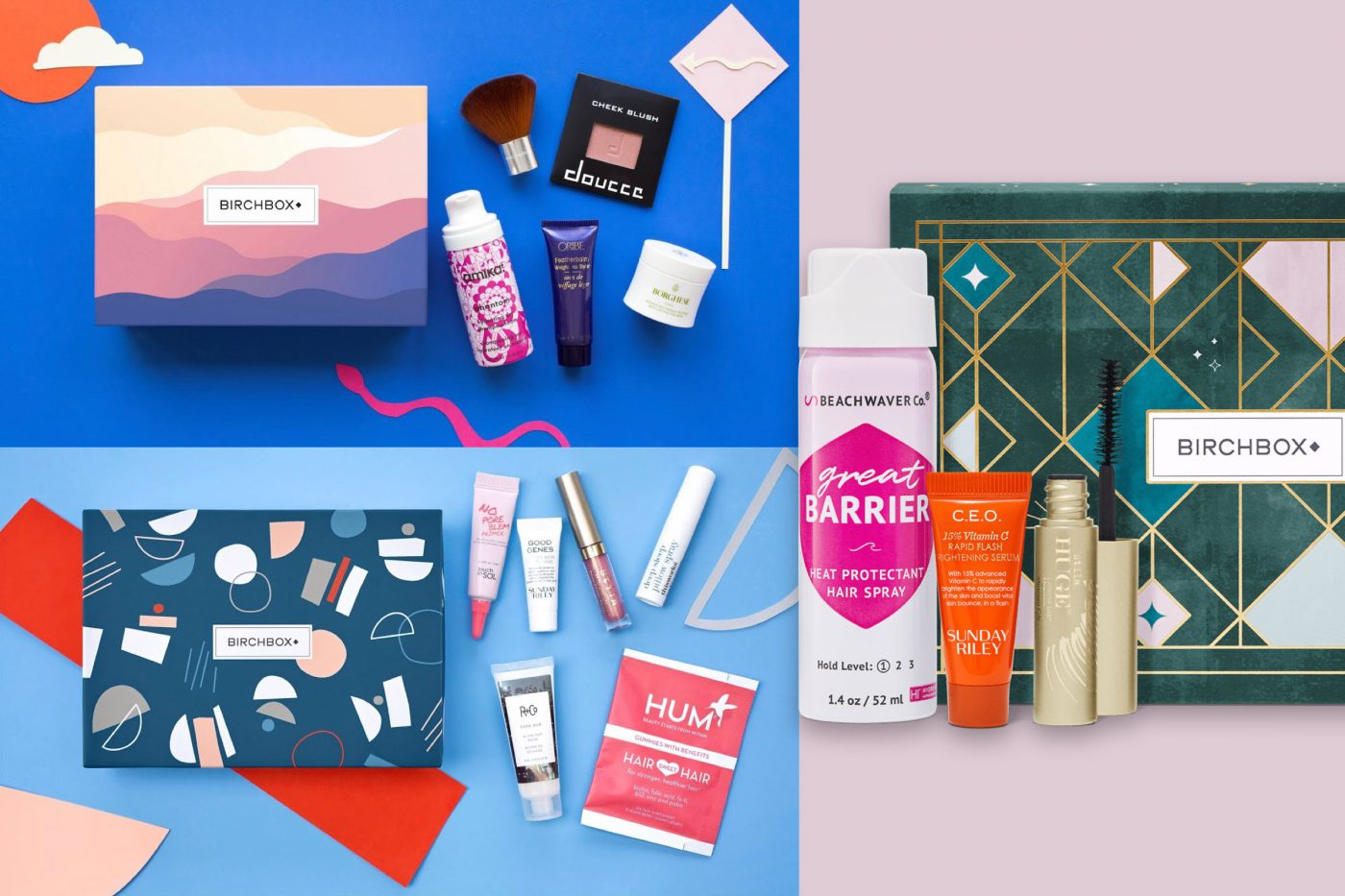

Every month, Birchbox, a subscription make-up service, offers its clients as many as 5 samples of new cosmetic products to try. This provides for a successful surprise effect, accompanied by a particularly captivating unboxing experience (every month there is a package with a particular design).

Storytelling is a central element in their communication. Huel offers its consumers a new and articulated point of view of nutrition via a range of recipes studied by professional nutritionists. They do not limit themselves to promoting the quality of their product. Instead, they fight to raise awareness on the food emergency and the excessive exploitation of environmental resources for the production of food of animal origin.

One outstanding example is the Ohne brand of organic cotton sanitary pads which focuses its communication on overcoming the taboo of menstruation, still often seen as a source of embarrassment. The brand has embraced the mission of combating all of the gender stereotypes, going beyond the specific theme of menstruation.

They independently collect data on their clients in order to guarantee a tailor-made approach. Graze analyses the tastes of its consumers before sending them the monthly box of snacks, thus selecting only the items which are most in line with their preferences.

Boll & Branch, which proposes organic cotton sheets, has decided to open a bricks-and-mortar retail store in response to the desire of its clientele to have hands-on experience of the pleasure and quality of the products, demonstrating the modern and unusual passage from online to offline (rather than the opposite, which was the case in the past).

Where does the innovation lie? How do they manage to stand out so much from the crowd?

By side-stepping traditional channels, designing the product in-house and creating a relationship of extreme trust with clients which is based on shared values.

These brands have been consolidating growth and turnover for a number of years now, becoming reference points rather than a flash in the pan. In illustration, Gillette’s market share for men’s razors in the USA fell in 2016 to 54% from the 2010 level of 70%, while the shares of the Dollar Shave Club and Harry’s have climbed to 12.2% from 7.2% in 2015 (Fox Business, 2017); the increase in turnover of grocery stores in general is forecast to be around 1% in 2022, while the meal kit market is expected to grow ten-fold in the same period2.

The fundamental idea of these small emerging entities is that their business model is based on a relationship with the client. It is a relationship which takes the form of personalised services and with a customer experience which has never been tried before, where what really counts is the overall service, embodying positive desires, values and emotions more than the physical product itself. Through continuous feedback and two-way communication, brands can constantly improve this relational aspect.

All of this has an effect not only on entities which are currently emerging, but also on those which are already established, leading to a re-thinking of the roles of all the channels of communication and contact with brands, including bricks-and-mortar stores which far from disappearing are ever increasingly conceived to complete (or begin) that which digital spaces have started. It is no coincidence that even a brand such as Nike is following the example of new, small-scale entities, adapting to direct-to-consumer trends, and between 2010 and 2020, the forecasts for the results of its new direct-to-consumer strategies show a shift in turnover from 19 billion dollars to 50 billion.

Irene Serafica

Chief Strategy Officer at CBA

Subscribe and receive CBA’s latest news directly in your inbox!

© CBA DESIGN 2021 – CB’A Srl 05940620965

Privacy Overview